Corporate Venturing Squads (CVSs) are an emerging trend in collaborative innovation, combining corporations and start-ups to address complex challenges and drive technological advancements. By leveraging strategic alliances, CVSs enhance open innovation, enabling corporations to share resources, risks, and opportunities while boosting credibility and visibility. This document, based on 50 CVS case studies, outlines various CVS typologies, their roles, and the mechanisms they employ, offering valuable insights into their structure and impact on corporate innovation.

Main Points

- Definition and Purpose of CVSs: CVSs are multi-partner strategic alliances that combine the strengths of corporations and start-ups to innovate collaboratively. These alliances foster open innovation, enabling members to address high-risk challenges and gain competitive advantages through resource sharing and collective problem-solving.

- Types of CVSs: The study identifies six CVS types based on their main activity (scouting, testing, or investing) and collaboration frequency (one-shot or recurring): Scouting Forces, Scouting Platforms, Joint Proof of Concept (PoC), Partnerships, Co-investments, and Joint Funds. Each type serves unique innovation objectives and operational structures.

- Key Activities: CVSs engage in three primary activities: scouting for start-up opportunities, testing new products and services through joint initiatives, and co-investing in promising ventures. These activities help corporations access deal flow, share risks, and enhance their innovation capabilities.

- Benefits for Corporations: The top benefits include better access to start-up deal flows (37%), improved network effects (29%), knowledge sharing (26%), increased credibility and visibility (4%), and reduced costs and risks (4%).

- Challenges and Risks: CVSs face challenges like managing diverse partner interests, higher coordination costs, and the potential for knowledge leakages. Addressing these issues requires effective governance, shared goals, and clear communication among members.

- Role Differentiation within CVSs: Three distinct roles exist within CVSs: problem owners (corporates facing challenges), enablers (facilitators like consulting firms or government bodies), and CVS alliance managers (internal or external coordinators ensuring operational efficiency and collaboration).

- Diversity in CVS Membership and Size: The study reveals that CVSs vary in size, from small groups of 2-5 members (common in joint PoCs) to larger networks of 10+ members (found in partnerships and scouting platforms). Size impacts collaboration dynamics and decision-making processes.

- Mechanisms Employed by CVSs: Common mechanisms include challenge prizes, corporate accelerators, scouting missions, and venture capital investments. These tools are selected based on the CVS’s type and objectives, balancing cost, speed, and commitment.

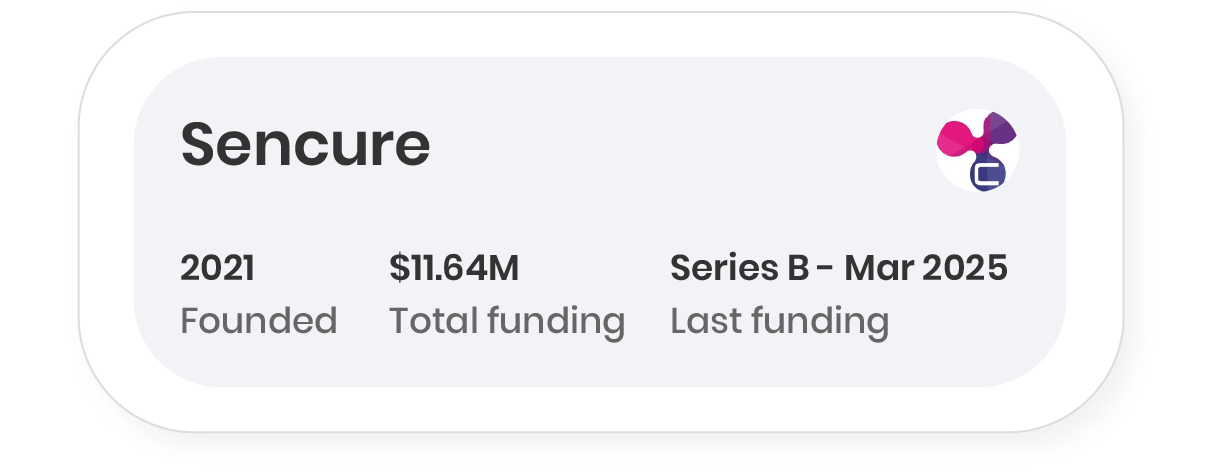

- Industries and Geographical Scope: CVSs operate across diverse industries, including ICT, healthcare, energy, and construction, and are active globally, with notable initiatives in North America, Europe, and Asia-Pacific. This geographical diversity underscores the universal applicability of CVSs.

- Future Implications and Recommendations: CVSs represent a significant shift in corporate innovation strategies, emphasizing collaboration over competition. For corporate leaders, understanding CVS structures and selecting the right type is crucial to maximizing innovation outcomes and achieving strategic goals.