Find targets and understand markets. Accurately.

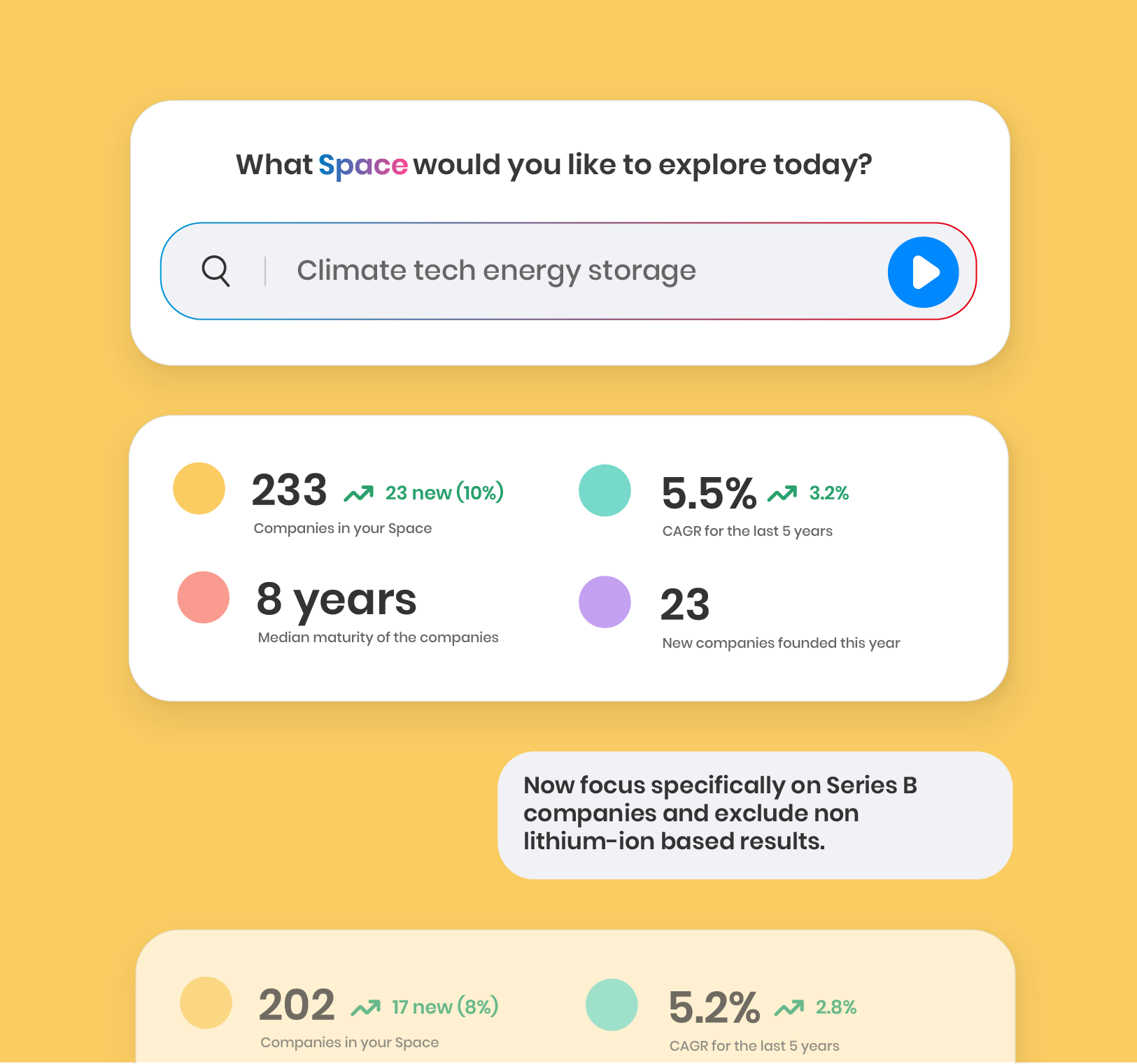

FounderNest continuously scans global markets to surface high-fit opportunities, validate strategic alignment, and give your team the foresight to act before competitors.

47%

More relevant opportunities

21x

Faster market scanning

12x

More efficient due diligence

M&A teams thrive on precision, speed, and confidence. FounderNest empowers your team to continuously identify the right targets, validate fit, and stay ahead of the market, before competitors make a move.

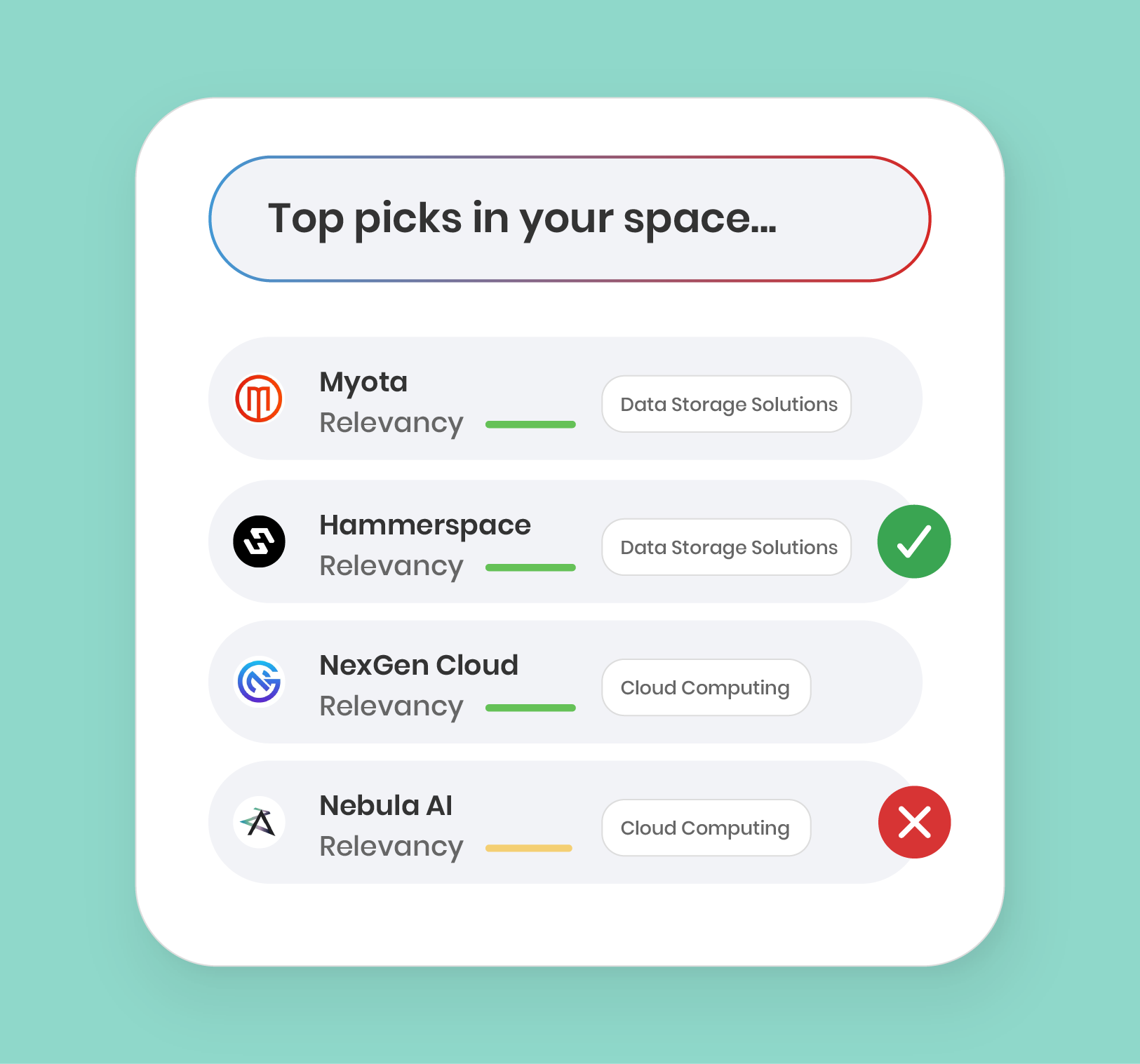

Uncover hidden acquisition targets.

Our AI Market Intelligence Analyst (AMIA) scans millions of private companies across industries and regions, surfacing high-fit acquisition candidates that align with your strategy. No cold lists, just warm insights.

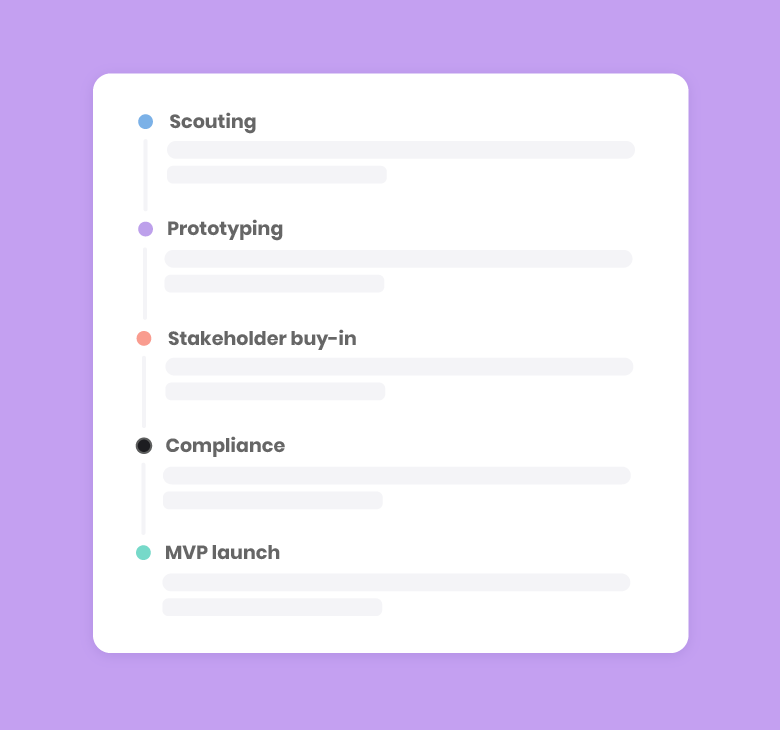

Streamline due diligence.

Centralize key metrics, financial signals, and strategic fit indicators in one platform. Eliminate manual research, accelerate validation, and enter negotiations with confidence.

Accelerate deal execution.

Cut weeks off the scouting and evaluation cycle. FounderNest enables secure collaboration across internal stakeholders, so decisions are faster, alignment is tighter, and deals close quicker.

Use cases for M&A teams.

Frequently asked questions:

-

How does FounderNest help M&A teams find the right targets?

FounderNest’s AI continuously scans millions of private companies across industries and regions. Instead of generic lists, it surfaces only those that match your strategic, financial, and operational criteria, ensuring your pipeline is filled with high-fit, actionable opportunities.

-

Can FounderNest support both domestic and cross-border deals?

Yes. The platform is designed for global coverage, scanning data across markets, industries, and geographies in real time. Whether your focus is local consolidation or international expansion, FounderNest delivers relevant opportunities wherever you operate.

-

How reliable and current is the company data?

FounderNest combines advanced AI with verified public and proprietary sources. Data is refreshed continuously, giving your team the most up-to-date and comprehensive signals on company activity, growth, and market movements.

-

Does the platform integrate with our CRM or deal management tools?

Absolutely. FounderNest integrates with leading CRMs and pipeline management platforms, making it easy to sync opportunities, streamline workflows, and keep your deal process centralized.

-

Can it be customized to our specific acquisition thesis?

Yes. You can configure the platform to reflect your unique investment criteria - from strategic fit and geography to size, sector, and growth potential, so that every opportunity aligns with your thesis.

-

How does FounderNest accelerate due diligence?

FounderNest enriches company profiles with key insights such as financial indicators, growth signals, leadership backgrounds, and competitive positioning. This reduces manual research, shortens validation cycles, and lets your team focus on high-value analysis instead of data gathering.

-

How quickly can we start seeing qualified targets?

Most M&A teams start seeing relevant opportunities within minutes of onboarding. Because FounderNest’s AI continuously scans the market, your pipeline is always refreshed with new, high-fit targets as soon as they emerge.

What leading M&A professionals say.

“FounderNest has been incredibly valuable in mapping out the market, providing key insights such as company founding dates, funding history, and expanding our reach to more relevant companies. It’s naturally helping us meet our KPIs by streamlining our access to the right opportunities.”

Shiva Chandra

Senior Associate at Kyocera“We’ve been able to reduce the amount of time that is needed for scouting by 30%. That gives us the opportunity to either run or test the solution a bit longer or reduce the total duration of the project.”

Marina Lutzenberger

Senior Project Manager Corporate Strategy & Digitalization at Fraport AG“FounderNest has become an essential tool for us, sharpening our innovation edge and propelling Novo Nordisk towards the future of healthcare.”

Lluc Diaz

Director, Digital Innovation at Novo NordiskThe past can’t compete. the future is already here.

The old way.

Traditional methods are fine when you know exactly what to search for, but you still end up with missed companies, endless noise to sift through and a huge lack of insights.

The new way.

Say goodbye to generic databases, endless hours of research and incomplete intel - say hello to personalization, efficiency and accuracy you never thought possible.

Uncover 20% more opportunities.

See FounderNest in action and bring your M&A vision to life.

No obligation, Zero worry.