How AI-driven automation, intelligent workflows, and knowledge systems are reshaping how large organizations manage and scale their workforce.

AI workforce operations encompasses technologies that automate processes, augment employee productivity, and systematize organizational knowledge. With 772 companies identified, the category spans early-stage innovators to global incumbents driving enterprise transformation. As of December 2025, the sector shows accelerating growth, significant capital inflows, and rapidly maturing tools for intelligent automation.

FounderNest identified 772 companies across two core subspaces, collectively raising $208.75B in publicly disclosed funding rounds.

These players range from RPA vendors orchestrating digital workflows to knowledge management platforms enabling searchable institutional memory enriched with AI.

Download the market report

2 key subspaces analyzed

Robotic Process Automation (RPA)

Automation of repetitive tasks, workflows, and business processes using software bots to improve efficiency and reduce manual intervention.

Knowledge Management Systems (KMS)

AI-powered platforms that organize, store, retrieve, and distribute organizational knowledge, enhancing collaboration and decision-making.

Key market trends

Intelligent task automation

RPA continues to expand from rule-based automation toward AI-enhanced decisioning. Companies adopt increasingly autonomous digital workers capable of handling multi-step, cross-department workflows.

Enterprise knowledge centralization

KMS platforms evolve into AI copilots for the workforce, surfacing answers, generating content, and enabling contextual knowledge retrieval in real time.

Workforce productivity and augmentation

Tools focus on eliminating low-value tasks, democratizing access to information, and equipping employees with AI-enhanced capabilities at scale.

Rapid adoption driven by operational pressure

Organizations face rising expectations around speed, accuracy, compliance, and cost efficiency. AI workforce solutions deliver measurable ROI through automation, error reduction, and agility.

Space snapshot

What the space looks like today (Dec 2025)

- Total companies analyzed: 772

- Total funding raised: $208.75B

- Median rounds per company: 2

- Median amount raised: $48.5M

- Median headcount: 31 employees

- Median maturity: 9 years

- CAGR in companies: 7.3%

- CAGR in funding: 20.6%

- HQ distribution: 58% United States; remainder across Europe, Canada, Asia, LatAm

Funding distribution by region

- United States: $202.19B · 568 rounds · 444 companies

- Europe: $4.63B · 93 rounds · 263 companies

- Canada: $1.94B · 23 rounds · 44 companies

- Asia: $750K · 4 rounds · 12 companies

- LatAm and Caribbean: 8 companies · no disclosed funding

- Australia and Africa: no disclosed funding

Funding structure

- Median raised per company: $48.5M

- Median number of rounds: 2

- Most common “last round” categories include Pre-Seed, Seed, Series A–C, and various private equity and M&A events.

Workforce characteristics

- 40% of companies have fewer than 20 employees

- Headcount is heavily concentrated in the 1–20 and 21–50 employee brackets, reflecting early-stage prevalence

Space in context

How the space is evolving

Company growth

- 7.3% CAGR in number of companies (last 5 years)

- 40 new companies founded in 2024

- Median maturity: 9 years

Funding evolution

- 20.6% CAGR in funding over the last 5 years

- Strong upward trend in both amount raised and number of rounds since 2020

Top investors

781 unique investors have participated in the space.

Leading investors by breadth of portfolio:

- Lightspeed Venture Partners: 10 companies · 33 investments

- Salesforce Ventures: 12 companies · 20 investments

- Y Combinator: 12 companies · 16 investments

- Sapphire Ventures: 8 companies · 18 investments

- New Enterprise Associates: 8 companies · 16 investments

- Tiger Global Management: 8 companies · 14 investments

Most funded companies

Among surfaced companies, top fundraisers include:

- Anthropic: $33.74B · 16 rounds

- UiPath: $33.07B · 12 rounds

- Google (AI-related units counted): $23.08B · 4 rounds

- Dayforce: $20.26B · 5 rounds

- Zendesk: $10.92B · 11 rounds

- C3 AI: $10.03B · 11 rounds

20 companies accelerating the AI workforce operations space

Beyond the established leaders, there are a number of funded companies with under 50 employees in the AI workforce operations space.

To fully explore this growing sector and uncover promising startups, request a demo of FounderNest today.

Companies that may catch your eye in this space:

1. Guru

Enterprises waste significant time and budget searching for scattered information and duplicating work across teams. Guru centralizes company knowledge into an AI-powered workspace that surfaces contextually relevant answers directly in existing workflows, helping teams find trusted information faster, make better decisions, and work more efficiently.

Headquarters: Pittsburgh, United States

Founded: 1998

Headcount: 11–50

Funding: $41M, Acquisition, Jul 2003

Website: https://guru.com

LinkedIn: https://linkedin.com/company/992981

2. InVia Robotics

Manual warehouse operations slow fulfillment, increase error rates, and drive up labor costs. inVia Robotics delivers AI-powered warehouse automation through robots and orchestration software that optimize inventory movement and order picking, enabling e‑commerce, retail, and logistics providers to boost throughput, accuracy, and workforce productivity.

Headquarters: Thousand Oaks, United States

Founded: 2015

Headcount: 11–50

Funding: $59M, Series C, Jul 2021

Website: https://inviarobotics.com

LinkedIn: https://linkedin.com/company/invia-robotics

3. Automat AI

Repetitive browser workflows and document-heavy processes consume valuable time and are prone to human error. Automat AI offers a robotic process automation platform for Chrome that uses GPT‑4 and computer vision to capture on-screen actions, automate document workflows, and orchestrate end‑to‑end processes, helping businesses streamline operations and reduce manual work.

Headquarters: San Francisco, United States

Founded: 2023

Headcount: 11–50

Funding: $19.75M, Series A, Nov 2025

Website: https://runautomat.com

LinkedIn: https://linkedin.com/company/automat-ai

4. Sola

Knowledge workers often spend hours on repetitive desktop tasks that limit capacity for higher‑value work. Sola enables teams to build robotic agents powered by large language models and computer vision that learn from existing workflows and automate routine activities across legal, financial, insurance, and healthcare processes, accelerating execution while empowering non‑technical users to create automations.

Headquarters: New York, United States

Founded: 2023

Headcount: 1–10

Funding: $21M, Series A, Aug 2025

Website: https://sola.ai

LinkedIn: https://linkedin.com/company/sola-solutions

5. Robusta Cognitive Automation

Many organizations still rely on fragmented, manual workflows that are hard to monitor and optimize. Robusta Cognitive Automation provides an automation platform that combines robotic process automation with AI-driven cognitive capabilities, enabling users to visually design, deploy, and continuously improve processes so they can cut costs, reduce errors, and increase productivity.

Headquarters: Maslak, Turkey

Founded: 2017

Headcount: 11–50

Funding: Undisclosed, Seed, Nov 2021

Website: https://robusta.com.tr

LinkedIn: https://linkedin.com/company/robusta-ca

6. LEAD

Distributed teams struggle to identify internal experts, build relationships, and share knowledge effectively. LEAD.bot uses AI and organizational network analysis, integrated into Slack and Microsoft Teams, to map relationships, surface key influencers, and facilitate smart introductions that improve collaboration, engagement, and knowledge flow across the enterprise.

Headquarters: San Francisco, United States

Founded: 2019

Headcount: 1–10

Funding: $1.33M, Pre‑Seed, Mar 2021

Website: https://lead.app

LinkedIn: https://linkedin.com/company/leadforcareer

7. Slite

Growing teams often outgrow generic workspaces, leaving information scattered and outdated. Slite offers an AI-powered knowledge base that centralizes company docs—from onboarding guides to all‑hands notes, and delivers instant, trusted answers so teams can access up‑to‑date information without searching across multiple tools.

Headquarters: Paris, France

Founded: 2017

Headcount: 11–50

Funding: $15.4M, Series A, Apr 2020

Website: https://slite.com

LinkedIn: https://linkedin.com/company/slitehq

8. Lindy

Professionals waste countless hours managing calendars, inboxes, and routine workflows. Lindy provides an AI “employee” that handles tasks like scheduling, email drafting, sales and customer success workflows, and document processing, while turning internal content into a conversational knowledge base that supports teams as they scale.

Headquarters: San Francisco, United States

Founded: 2023

Headcount: 11–50

Funding: $49.9M, Series B, Jan 2023

Website: https://lindy.ai

LinkedIn: https://linkedin.com/company/lindyai

9. Elqano

Large organizations often struggle to locate internal expertise and reuse existing knowledge. Elqano uses AI to map employee skills, tag and centralize content, and route questions to the right experts, ensuring people quickly find answers and share knowledge through integrations like Microsoft Teams.

Headquarters: Geneva, Switzerland

Founded: 2014

Headcount: 11–50

Funding: $0.96M, Seed, Dec 2022

Website: https://elqano.com

LinkedIn: https://linkedin.com/company/18220481

10. Inventive AI

Sales teams lose velocity responding to complex RFPs and questionnaires using manual, inconsistent processes. Inventive AI delivers an AI-powered response management platform that centralizes knowledge, auto‑drafts responses, and embeds collaboration, enabling teams to accelerate submissions, improve quality, and reclaim time for selling.

Headquarters: Mountain View, United States

Founded: 2023

Headcount: 1–10

Funding: $4.5M, Seed, Aug 2024

Website: https://inventive.ai

LinkedIn: https://linkedin.com/company/inventive-ai

11. FuseBase

Scaling organizations often juggle multiple tools for client portals, internal collaboration, and knowledge management. FuseBase offers an AI-powered workspace that unifies branded internal and external portals, uses agents to automate onboarding and routine workflows, and centralizes documents so teams can collaborate securely and reduce tool sprawl.

Headquarters: Cleveland, United States

Founded: 2014

Headcount: 11–50

Funding: $1.7M, Seed, Aug 2024

Website: https://thefusebase.com

LinkedIn: https://linkedin.com/company/nimbus-web-inc

12. TUTORize

Enterprises with large workforces struggle to align learning, talent, and knowledge management in one place. TUTORize provides a modular, web‑based platform that combines learning, applicant, talent, and knowledge management to help organizations structure training, capture expertise, and support continuous development at scale.

Headquarters: Koblenz, Germany

Founded: 2011

Headcount: 11–50

Funding: $0.65M, Seed, Jan 2012

Website: https://tutorize.com

LinkedIn: https://linkedin.com/company/tutorize

13. Socrates

CRM users often face clunky, manual data entry and a fragmented customer context. Socrates is an AI‑native, multimodal CRM that uses agents and a knowledge layer to capture, understand, and surface customer insights automatically, helping teams move faster without spending time updating yet another system.

Headquarters: San Francisco, United States

Founded: 2024

Headcount: 1–10

Funding: Undisclosed, Pre‑Seed, Jul 2024

Website: https://socrateslabs.io

LinkedIn: https://linkedin.com/company/socrates-labs

14. Legman.IO

Construction projects often suffer from siloed data, outdated documentation, and slow information access. Legman.IO brings AI-powered knowledge management to the construction sector, organizing and making project information searchable so field and office teams can access the insights they need to deliver safer, more efficient projects.

Headquarters: Chicago, United States

Founded: 2023

Headcount: 1–10

Funding: $0.03M, Pre‑Seed, Mar 2024

Website: https://legman.io

LinkedIn: https://linkedin.com/company/legman1

15. Tur.ai

Enterprises often lack a business‑friendly way to design and govern AI and automation initiatives across functions. Tur.ai provides a platform‑as‑a‑service that lets business users and consultants design, build, and operate AI solutions and software robots, helping organizations reduce costs, improve process effectiveness, and scale intelligent automation in areas like customer experience, HR, and procurement.

Headquarters: Amsterdam, Netherlands

Founded: 2017

Headcount: 11–50

Funding: $1.45M, Seed, Oct 2024

Website: https://tur.ai

LinkedIn: https://linkedin.com/company/tur-ai

16. Robotiq.ai

Back‑office teams spend extensive time on repetitive digital tasks that could be fully automated. Robotiq.ai offers an enterprise‑grade RPA platform for building unattended software robots enhanced with deep learning and chatbot interfaces, enabling organizations to design, deploy, and monitor automations via a web editor and pay‑per‑use model that aligns cost with actual robot runtime.

Headquarters: Zagreb, Croatia

Founded: 2018

Headcount: 11–50

Funding: $1.06M, Seed, Apr 2021

Website: https://robotiq.ai

LinkedIn: https://linkedin.com/company/robotiq-ai

17. Kronnika

Organizations seeking to scale automation often lack reusable components and centralized governance. Kronnika builds high‑performance robotic libraries and scalable robot farms that automate repetitive processes, helping companies reduce costs, increase speed and accuracy, and build a lasting “corporate memory” of automated workflows.

Headquarters: Istanbul, Turkey

Founded: 2019

Headcount: 11–50

Funding: $0.75M, Seed, Dec 2021

Website: https://kronnika.com

LinkedIn: https://linkedin.com/company/kronnika

18. KAI

Enterprises generate massive volumes of unstructured documents that are difficult to organize and reuse. KAI provides an AI-powered knowledge management platform that semantically indexes, cleans, and structures content so teams can discover, connect, and apply knowledge more effectively, driving productivity and better decision‑making.

Headquarters: Versailles, France

Founded: 2023

Headcount: 1–10

Funding: $0.61M, Pre‑Seed, Jan 2025

Website: https://k-ai.ai

LinkedIn: https://linkedin.com/company/kai-knowledgeai

19. Tana

Knowledge workers often toggle between disconnected tools for notes, tasks, and AI assistance. Tana offers an AI‑native workspace that combines a knowledge graph, object‑based note‑taking, and configurable AI agents to help individuals and teams capture ideas, structure information, and move from thinking to execution with fewer steps.

Headquarters: Palo Alto, United States

Founded: 2021

Headcount: 11–50

Funding: $14M, Series A, Feb 2025

Website: https://tana.inc

LinkedIn: https://linkedin.com/company/tanainc

20. Evidium

Healthcare organizations struggle to turn rapidly evolving clinical evidence into actionable guidance at the point of care. Evidium offers a data‑centric platform with AI‑enabled clinical copilots and analytics that organize and deliver evidence‑based medical knowledge across care delivery and research, helping clinicians make informed decisions and improve patient outcomes.

Headquarters: San Francisco, United States

Founded: 2021

Headcount: 11–50

Funding: $22M, Series A, Nov 2025

Website: https://evidium.com

LinkedIn: https://linkedin.com/company/evidium

Conclusion

As companies seek to improve productivity, reduce operational friction, and scale knowledge across their organizations, AI workforce operations has become one of the most strategically important technology categories of the decade. With 772 companies and more than $208B in disclosed funding driving advancements in automation and intelligence, the shift toward AI-powered workflows is accelerating across every industry.

A new wave of innovators spanning robotic process automation, intelligent assistants, and AI-driven knowledge systems is redefining how work gets done, augmenting employees while enabling faster, more resilient operations. As this space continues to mature, the companies at the forefront will shape the future of enterprise efficiency, collaboration, and decision-making.

With FounderNest, we give you the best company scouting tool and valuable market intelligence from our AI analyst.

Comprehensive market coverage: 50m+ companies, 10bn+ data points, 160m+ patents, 160m+ papers and articles, 500k+ clinical trials, 100m+ authors and key opinion leaders, 115k+ research entities, and 300m+ smart insights – all in one AI market intelligence platform.

Spaces: Create a detailed market space using our AI prompts so you cut out the noise and focus on the companies that matter.

Key Contacts: Identify key decision-makers and their contact details using AI so you only get in touch with the ones that you’ll gain most engagement from.

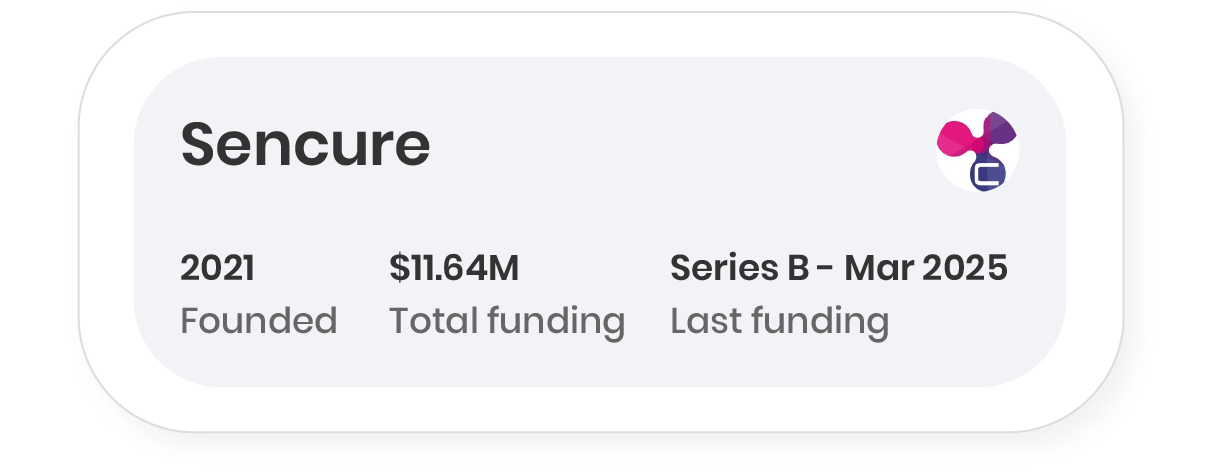

Funding: Get a clear picture of the funding rounds and their investors for each company in seconds.

… and much much more!