1. Venture Building as a Growth Priority

- Half of surveyed CEOs rank venture building among their top three strategic priorities.

- Despite economic challenges like inflation and high interest rates, new-venture building remains resilient and has even gained importance since before the pandemic.

- Companies investing at least 20% of their growth capital in venture building achieve 2% higher revenue growth than those that do not.

2. The Role of Technology & AI in Venture Building

- 60% of CEOs expect to build AI-enabled ventures within the next five years.

- Gen AI is a key focus, particularly for businesses looking to create “copilot” models (AI-enhanced decision-making) and hyperpersonalized services.

- AI-powered ventures are expected to reshape industries like healthcare, finance, and retail by automating operations and improving customer engagement.

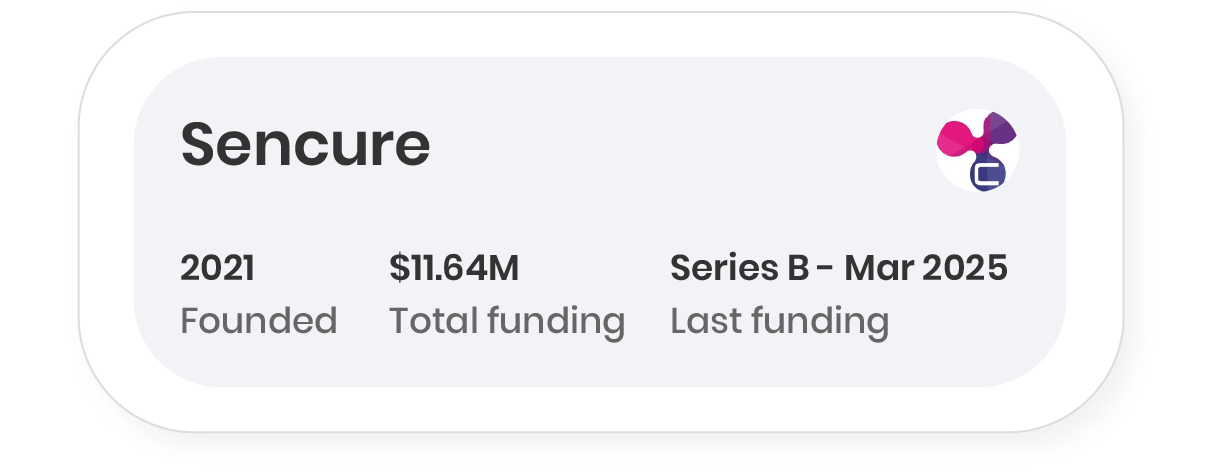

3. Capital Constraints vs. Growth Potential

- Limited capital availability is the biggest obstacle to venture building.

- Some companies are turning to external capital (venture capital, private equity) to overcome funding limitations.

- Expert venture builders see significantly higher returns: companies that commit funding up front and protect their venture budgets see greater success.

4. Venture Builders vs. Novices: A Performance Gap

- Companies with mature venture-building capabilities see 2.8% higher organic growth and twice the success rate compared to those that lack structured venture-building processes.

- The top 10 corporate ventures of the past decade have 1.5 times the revenue of the largest startups, indicating that incumbents can outperform traditional startups in revenue generation.

5. Unlocking Hidden Business Potential

- Nearly 90% of executives believe their company has untapped assets that could be turned into new businesses.

- Common sources of new ventures include:

- Data assets that can be monetized.

- Intellectual property that can be commercialized.

- Existing internal products that can be sold externally.

6. Key Actions for Successful Venture Building

The most successful venture builders follow these six key actions:

- Take a disciplined portfolio approach – Spread investments across multiple ventures to maximize success.

- Dedicate funding – Secure and protect venture capital investment early on.

- Balance independence with core business support – Give ventures autonomy while leveraging corporate strengths.

- Ensure strong leadership support – CEO and C-suite sponsorship significantly impact success.

- Build specialized teams – Invest in skilled venture-building teams and offer competitive compensation.

- Look beyond internal capabilities – Leverage acquisitions, partnerships, and external expertise to fill capability gaps.