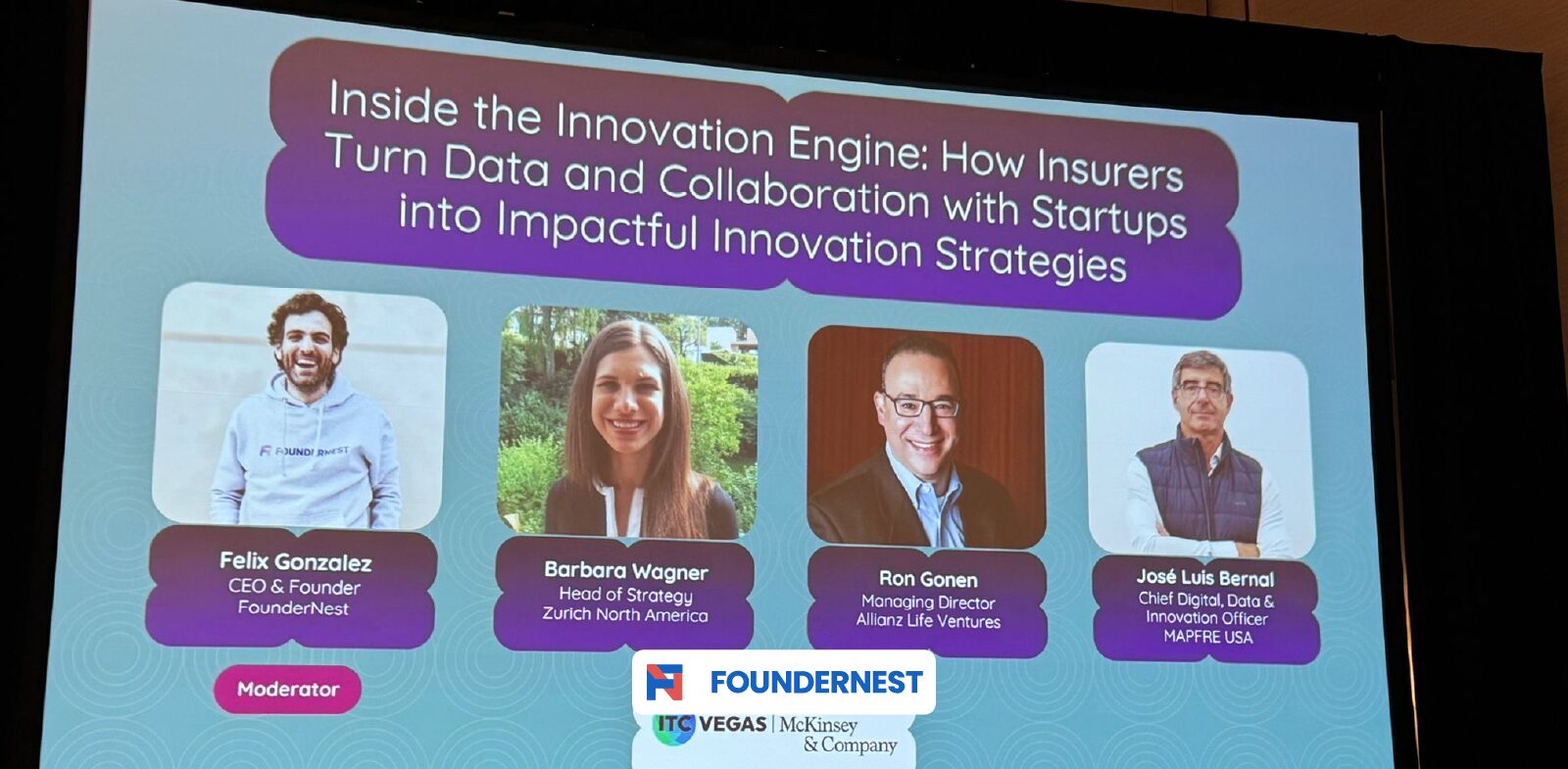

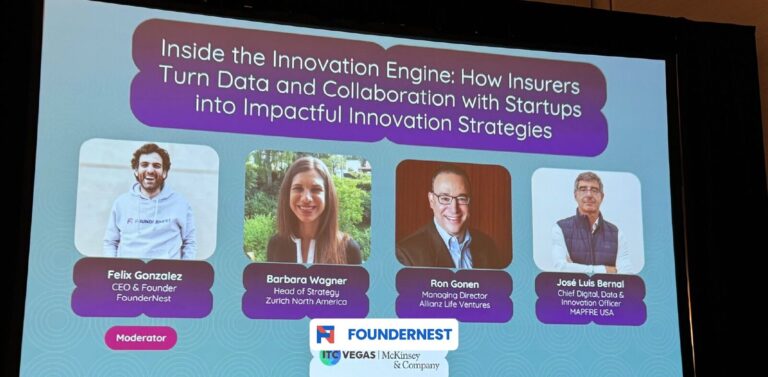

At this year’s InsureTech Connect (ITC) Vegas on Wednesday, October 15, 2025, the energy in the room was electric with a mix of optimism, realism, and curiosity about what’s next for insurance innovation. Helping innovators in insurance is something we’re passionate about at FounderNest.

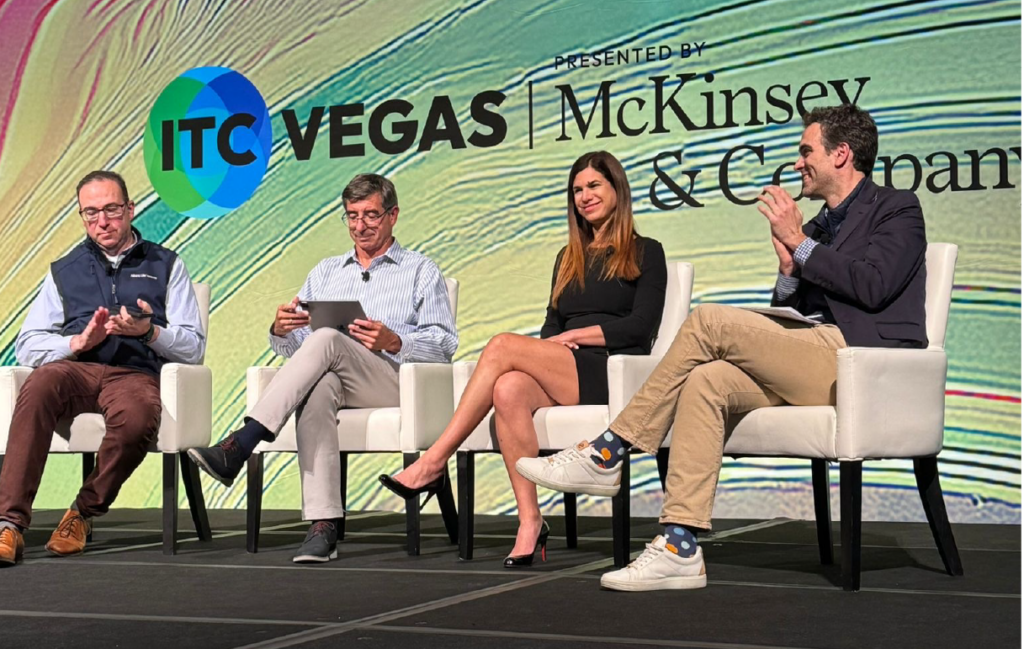

Moderated by Felix Gonzalez, CEO of FounderNest, the panel brought together three powerhouse voices in insurance strategy and innovation:

- Barbara Wagner, Head of Strategy, Zurich North America

- Ron Gonen, Managing Director at Allianz Life Ventures

- José Luis Bernal, Chief Digital, Data & Innovation Officer at MAPFRE USA

Together, they unpacked what it really means to turn data, AI, and innovation into measurable business impact, and how insurers can bridge the gap between vision and execution in a rapidly changing industry.

“Sometimes innovation is seen as a cost,” Felix opened, “but what are the keys to building internal alignment around its ROI, or even better, its Return on Value?”

And with that opening question, the conversation took off.

1. Innovation isn’t a cost center, it’s a value multiplier

If there was one theme that resonated throughout the discussion, it was this: innovation can’t just be measured in short-term ROI.

Barbara Wagner was the first to jump in. “You have to think Return on Value, not just ROI,” she said. “The real question is, what’s the cost if we don’t innovate?”

That question hit home for many in the audience. In an industry traditionally focused on risk management and long-term stability, innovation can feel like a “nice-to-have.” But as the panelists agreed, the true risk is in standing still.

José Luis Bernal of MAPFRE put it bluntly: “Innovation that’s disconnected from business units is just theater. But when you link it to real business challenges, that’s when it moves the needle.”

Ron Gonen added that insurers have to shift their mindset from cost to capability. “We’re not just investing in startups or technologies,” he explained. “We’re investing in new ways to solve customer problems, and that has compounding value over time.”

2. Strategy and innovation: A two-way street

When asked how innovation connects with corporate strategy, the panelists didn’t hesitate and all agreed that ‘alignment is everything.’

“In most cases, strategy comes first,” said Barbara. “It defines the direction, and innovation follows to support that journey.”

But she was quick to point out that it’s not always linear. “Innovation can and should inform strategy. Sometimes an experiment or emerging trend shows us something we couldn’t see before, and that influences the next strategic move.”

Ron agreed, noting that innovation teams often act as “early warning systems” for where markets are heading. “We see trends in startups and technologies long before they show up on a P&L,” he said. “That’s incredibly valuable for shaping corporate strategy.”

In other words, it’s not strategy vs. innovation, but more strategy with innovation in constant dialogue.

3. The startup corporate playbook: Relevance rules

At any insurtech event, you can feel the tension, and the opportunity between startups and large insurers.

So Felix asked what every founder in the audience was thinking: “If I’m a co-founder trying to work with a large insurer, what’s the playbook for breaking through?”

The panel’s response was refreshingly candid.

“Make your outreach relevant,” said José Luis. “Do your homework. Understand our priorities, and don’t send a generic pitch. When you can connect your solution directly to a business need we’re trying to solve, that’s when we listen.”

Ron added that the best partnerships aren’t vendor relationships; they need to be strategic collaborations. “When a startup becomes an extension of our innovation team, that’s when magic happens. We’ve seen startups help us build capabilities faster than internal teams could alone.”

That sense of partnership, one of being “in the trenches together”, is what separates a transactional vendor from a transformational collaborator.

4. Bridging the speed gap: How insurers are learning to move faster

The startup world moves at lightning speed. The insurance world… not so much.

Felix smiled as he posed the question: “What’s one thing you’ve changed internally to bridge that gap and avoid killing innovation with process?”

Barbara laughed. “The trick,” she said, “is to streamline early steps and leave the friction for later.”

She explained that her team categorizes experiments by risk level. “If the impact is low and the risk is minimal, we go fast. We test, learn, and pivot. If it’s a higher-risk initiative, we build in more governance, but not at the start so that we can start to gain traction.”

Ron agreed. “The goal isn’t to move recklessly, but to create a system where speed and safety can coexist. You can move fast if you know where the guardrails are.”

José Luis added that learning to “pivot fast” is just as important as moving fast. “If something’s not working, we don’t get stuck defending it. We learn, adjust, and move forward.”

With a speed with purpose mindset may just be the secret sauce for innovation in a traditionally cautious industry.

5. Separating AI hype from real opportunity

It wouldn’t be ITC Vegas without talking about AI.

Ron Gonen shared that Allianz Life Ventures is constantly pitched by startups claiming to be “AI-driven.” But cutting through the noise requires discipline. Just because something has the tag ‘AI’, it doesn’t mean that it solves a business problem.

“Customer validation is everything,” he said. “We ask: is this solving a real customer challenge? Is it improving an internal process that drives measurable outcomes? If not, it’s just noise.”

Barbara added that it’s about finding technologies that integrate with the business, not just impress it. “The excitement around AI is real, but it has to tie back to the customer journey or operational value.”

José Luis nodded. “Technology is the easy part. Culture is hard. You can buy tools and platforms, but changing the way people work, that’s the real challenge.”

6. Global innovation: Europe vs. the U.S.

With panelists from both sides of the Atlantic, Felix couldn’t resist asking: “Do you see differences between how innovation happens in Europe versus the U.S.?”

José Luis, who has worked across both regions, offered a nuanced answer. “There has to be a symbiotic relationship between corporate headquarters and local teams,” he said. “Global teams are great at coordination and setting direction, but local teams know the market realities. Innovation only works when those two are in sync.”

Barbara agreed, noting that successful global insurers balance global frameworks with local experimentation. “You can’t run innovation entirely from HQ,” she said. “You need people on the ground who understand customers and can adapt solutions to local needs.”

7. What’s next? The tech that could define 2026

As the conversation turned toward the future, Felix asked the panelists to share one technology or trend they’re watching closely.

The answers came fast:

- Voice AI for customer support

- Agentic AI for customer experience and underwriting

- Quantum computing for data processing and risk modeling

While each technology sits at a different stage of maturity, all three represent the next frontier of what’s possible when insurers rethink how data and intelligence can drive decisions.

Barbara summed it up perfectly: “The insurers who experiment responsibly today will define the industry tomorrow.”

8. Final thoughts: Innovation is a team sport

As the panel wrapped, Felix brought the conversation back to where it began, connecting innovation to business value.

“What stood out to me,” he said, “is that innovation isn’t about chasing trends. It’s about asking the right questions: what if we don’t do this? What value could we unlock if we try?”

That mindset, one rooted in curiosity, courage, and collaboration, echoed long after the session ended.

And if the energy at ITC Vegas 2025 was any indication, the insurance industry is far from standing still. It’s experimenting, partnering, and reimagining what’s next.

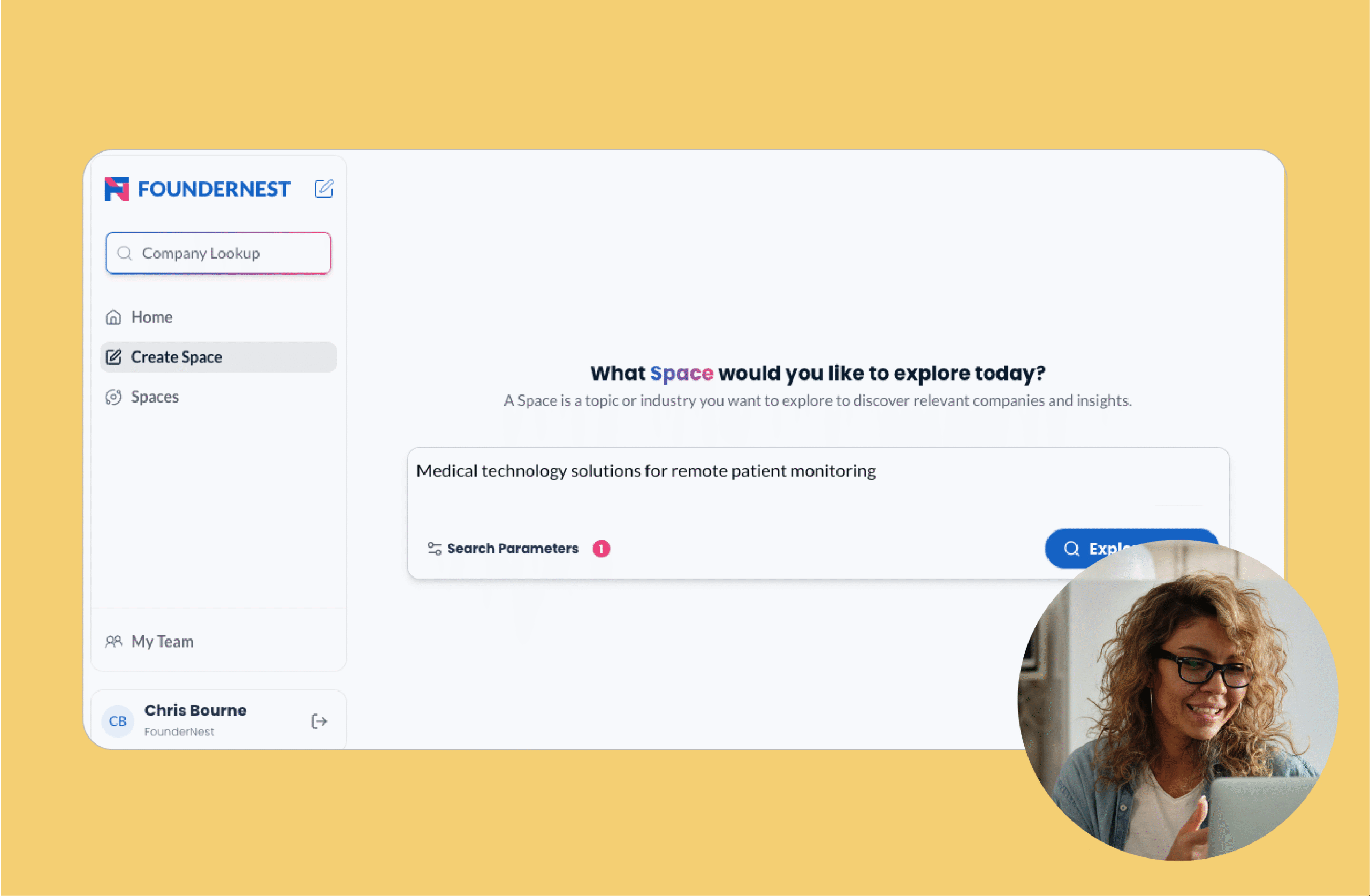

Bonus: The ultimate ITC Vegas 2025 company list

Looking to explore the startups, scale-ups, and innovators that made waves at this year’s show? We’ve compiled the full list of companies from ITC Vegas 2025, from early-stage insurtech disruptors to global leaders shaping the future of insurance.

👉 Download the full company list here.

Key Takeaways for 2025 (and Beyond)

- Think Return on Value, not just ROI. The cost of not innovating is often higher than the cost of trying and failing.

- Make innovation and strategy inseparable. One sets direction; the other finds new paths forward.

- Bridge the speed gap smartly. Remove friction early, add governance later.

- Separate hype from substance. Real innovation solves real problems.

- Embrace global-local balance. Innovation thrives where coordination meets localization.

- Keep experimenting. Voice AI, Agentic AI, and Quantum may sound futuristic now, but tomorrow, they’ll be table stakes.

Author: FounderNest Editorial Team

Event: InsureTech Connect (ITC) Vegas 2025

Moderator: Felix Gonzalez, CEO at FounderNest

Panelists: Barbara Wagner (Zurich North America), Ron Gonen (Allianz Life Ventures), José Luis Bernal (MAPFRE USA)

Want to attend the 2026 event? More information is here.