For many innovation leaders, the hardest part of their job isn’t generating ideas.

It is getting funding approved.

You can have the strongest strategy, the smartest team, and the most compelling technology in front of you. But if the CFO doesn’t feel confident, the answer is usually a no.

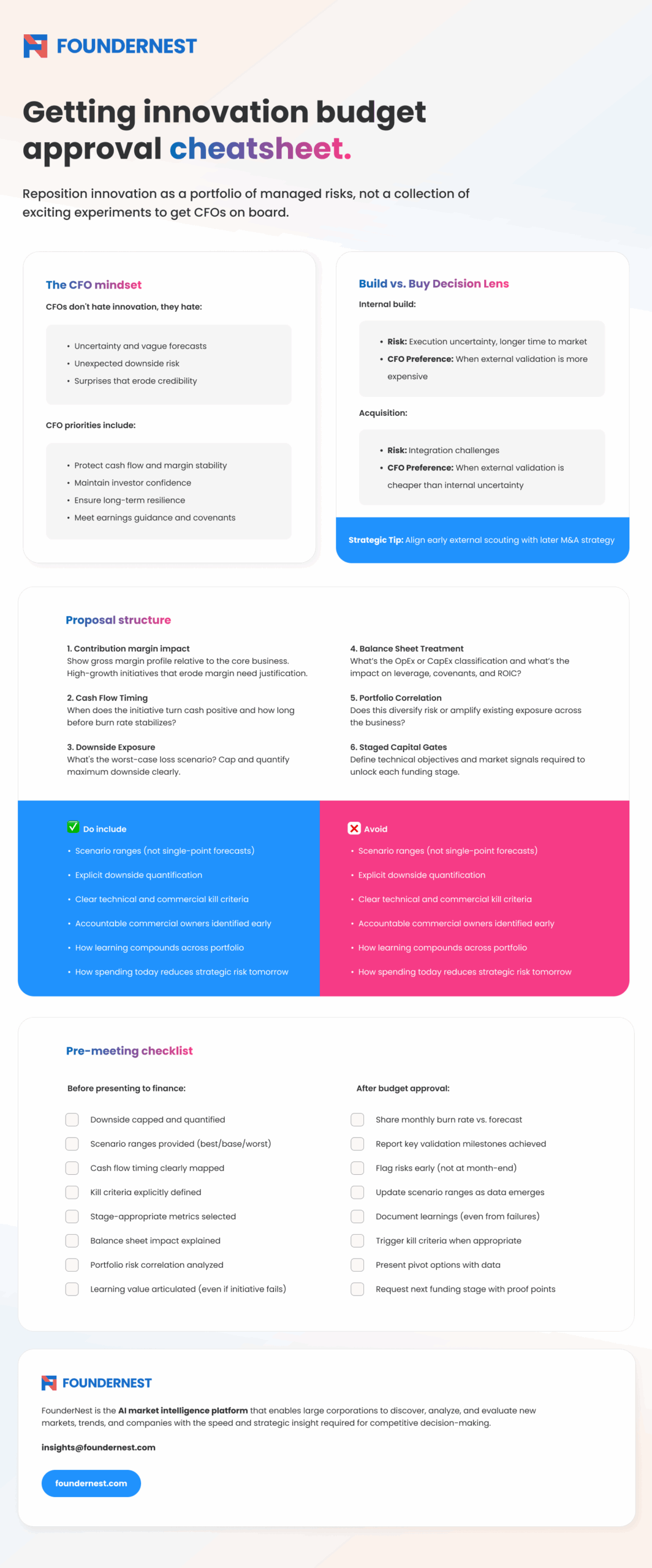

It doesn’t mean that most CFOs hate innovation. Instead, they hate uncertainty, vague forecasts, and unexpected downside risk.

Once you understand that distinction, funding conversations change entirely. The CFO’s role is not to block ambition. It is to protect cash flow, margin stability, investor confidence and long-term resilience.

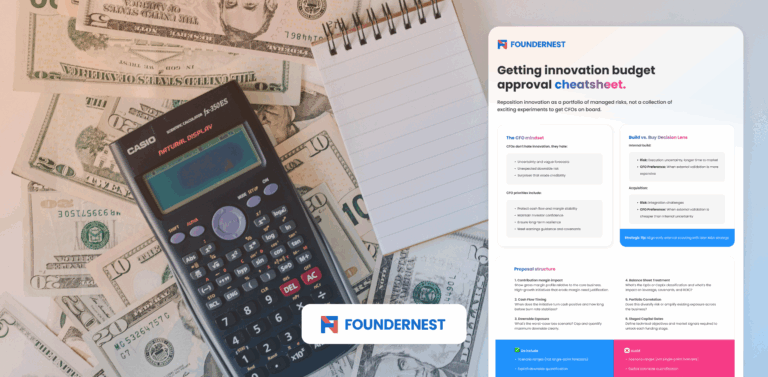

That’s why we created the Innovation CFO’s Cheat Sheet – your guide to guaranteeing that finance isn’t slowing down innovation.

Why CFOs hate surprises, not innovation

Finance leaders live in a world of forecasts, covenants, guidance and credibility.

Missing earnings even once can permanently damage market confidence a that context changes how innovation proposals are interpreted.

This is why innovation teams often feel misunderstood while CFOs feel frustrated with what they perceive as hand-wavy ROI models.

Once you reposition innovation as a portfolio of managed risks rather than a collection of exciting experiments, the tone of these discussions shifts quickly.

The metrics that actually matter to CFOs

Many innovation proposals fail because they are built around the wrong success metrics.

Vanity metrics like number of pilots, proof-of-concept success rates, or internal adoption figures rarely influence budget holders on their own.

What finance leaders care about is financial signal quality. They want to understand downside protection, upside leverage, timing of returns, and exposure to volatility.

Some of the most common metrics that consistently show up in approved innovation business cases include the following:

- Contribution margin impact: CFOs do not just want to see revenue potential. They want to understand the gross margin profile relative to the core business. A high-growth innovation that erodes margin can be strategically valuable, but it needs to be explicitly justified.

- Cash flow timing: When does the initiative turn cash positive. How long before the burn rate stabilises.

- Downside exposure: What is the worst-case loss scenario? CFOs are often comfortable funding risky initiatives when the downside is clearly capped.

- Balance sheet treatment: Will this spend be treated as operating expense or capital expenditure. How does it affect leverage, covenants, and return on invested capital.

- Portfolio correlation: Does this initiative diversify risk relative to the core business, or amplify existing exposure. This question became particularly important after 2020 as many finance leaders saw correlated risks materialise simultaneously across markets.

It is not that CFOs want perfect certainty. They want structured uncertainty with boundaries.

The role of staged capital in innovation approval

One of the most effective financial tools for innovation governance is staged capital deployment.

Rather than requesting a large upfront budget, high-performing teams structure innovation like a sequence of financial options.

Each stage has a defined technical objective, market signal or commercial validation requirement.

Funding unlocks only when those signals materialise. This reduces forecast error, limits downside risk and creates natural decision points for continuation or termination.

Staged capital reframes the CFO relationship.

Instead of asking for belief in the full innovation vision upfront, you are asking for permission to test a specific assumption under controlled conditions.

How innovation metrics should evolve from exploration to scale

A common reason CFOs lose confidence in innovation pipelines is metric stagnation. Too many teams apply early-stage metrics far too long into maturity.

During exploration, learning velocity and hypothesis validation matter most. During validation, customer acquisition cost, retention and unit economics take priority.

During scale, cash flow, margin stability and return on capital dominate.

High-performing teams deliberately shift metric frameworks as initiatives progress, rather than freezing success definitions at the pilot stage. This helps finance leaders see maturity rather than perpetual experimentation.

The hidden psychological contract between innovation and finance

Beyond spreadsheets and models, there is a psychological dimension to CFO approval that is rarely discussed openly.

Finance leaders carry institutional memory of failed initiatives, sunk costs and reputational risk.

Every new innovation proposal is unconsciously filtered through that history. This is why transparency matters so deeply.

When innovation teams openly share uncertainty, failure data and uncomfortable trade-offs, they build credibility over time.

When they oversell certainty or hide risk until late-stage execution, they destroy trust that can take years to rebuild.

In many organisations, CFO resistance is not about the current proposal. It is a residual response to how past innovation projects were positioned versus how they ultimately performed.

When M&A becomes the innovation funding shortcut

In some enterprises, innovation funding increasingly shifts from internal budgets to acquisition strategy. Rather than funding long internal build cycles, companies acquire proven technologies and teams.

This approach shifts risk profiles significantly. The execution risk of building is replaced by integration risk post-acquisition. Half of acquisitions fail to meet their financial targets largely due to integration challenges.

So it’s no wonder that CFOs tend to prefer acquisitions when the price of validation externally is lower than the cost of internal uncertainty.

Innovation leaders who understand this dynamic can often align earlier external scouting work with later M&A strategy, creating a tighter link between exploration and capital deployment.

Why surprises kill innovation credibility faster than failure

Perhaps the most important takeaway for innovation leaders is this. CFOs do not punish failure nearly as harshly as they punish surprise.

Surprise erodes confidence in forecasting systems, governance processes and execution discipline. Once that confidence erodes, every future innovation proposal faces higher scrutiny and smaller risk tolerance.

The lowest-risk path to sustained innovation funding is not perfect success. It is consistent predictability.

How to structure innovation proposals that finance leaders trust

While every organisation is different, innovation proposals that consistently secure CFO support tend to share several structural qualities.

They present scenario ranges rather than single-point forecasts. They explicitly quantify downside exposure. They define clear technical and commercial kill criteria. They identify accountable commercial owners early. They explain how learning will compound across the wider portfolio even if the individual initiative fails.

And critically, they show how innovation spending today reduces strategic risk tomorrow rather than simply adding financial risk now.

Sources

https://www2.deloitte.com/us/en/insights/c-suite/cfo-insights/cfo-industry-insights.html

https://www.accenture.com/us-en/insights/strategy/cfo-capital-allocation

https://hbr.org/2018/01/why-startups-fail

https://www.christenseninstitute.org/disruptive-innovations/

https://www.bcg.com/publications/2022/how-to-boost-innovation-roi

https://www.nber.org/papers/w28326

https://hbr.org/2020/06/why-some-platforms-thrive-and-others-dont