Why most corporate innovation scouting fails

Most corporate innovation teams want to find the next great partner, pilot opportunity, or investment thesis. But many unintentionally sabotage themselves before they even start.

Scouting is often treated as a side project, a series of one-off searches, or a scramble when an executive asks, “What are we seeing in this space?”

The result is unsurprising. Slow decision-making, missed opportunities, and scouting motions that never quite scale beyond good intentions.

It leads to innovation teams using LLMs to drive their innovation scouting efforts forward. But AI tools like ChatGPT or Perplexity don’t work for innovation scouting.

Only 6% of executives are satisfied with their innovation performance, despite 96% having innovation as a strategic priority. That’s a 90-point gap between desire and reality.

The cost of poor scouting is real. Missing early-stage trends leaves competitors with a head start. And unclear criteria creates internal churn that drains both time and cost.

In truth, great innovation scouting is built on five core pillars.

The 6 essential pillars of great innovation scouting

Pillar 1: Map the space

Before sending a single email or attending a single event, the best teams map the landscape.

Reactive scouting, like googling a few companies or using ChatGPT and Perplexity, leads to partial visibility and biased discovery. Proactive market intelligence gives you the full picture before you begin outreach.

What “mapping the space” actually means

- Identify all relevant companies in your target market

- Track emerging trends and market shifts in real time

- Monitor industry news from trusted, reliable sources

- Build a dynamic database, not a static spreadsheet that’s outdated in two weeks

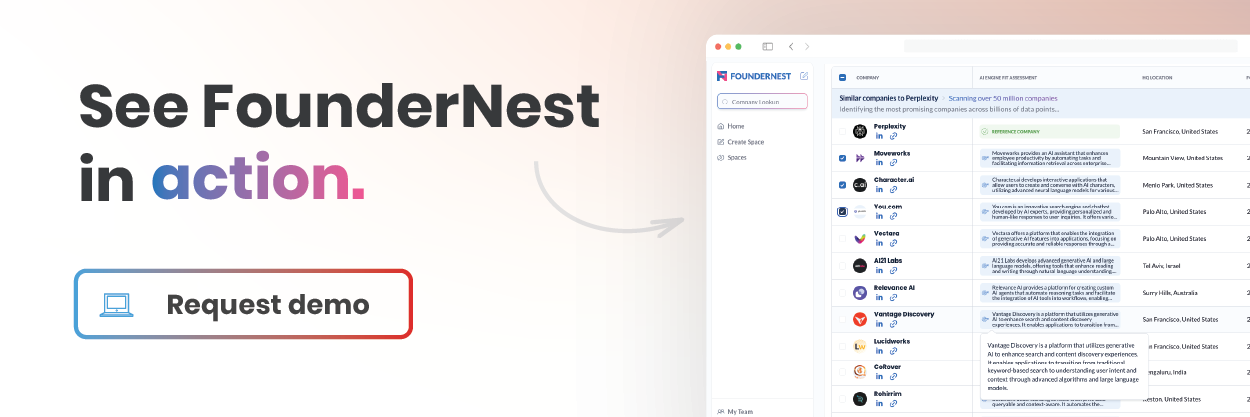

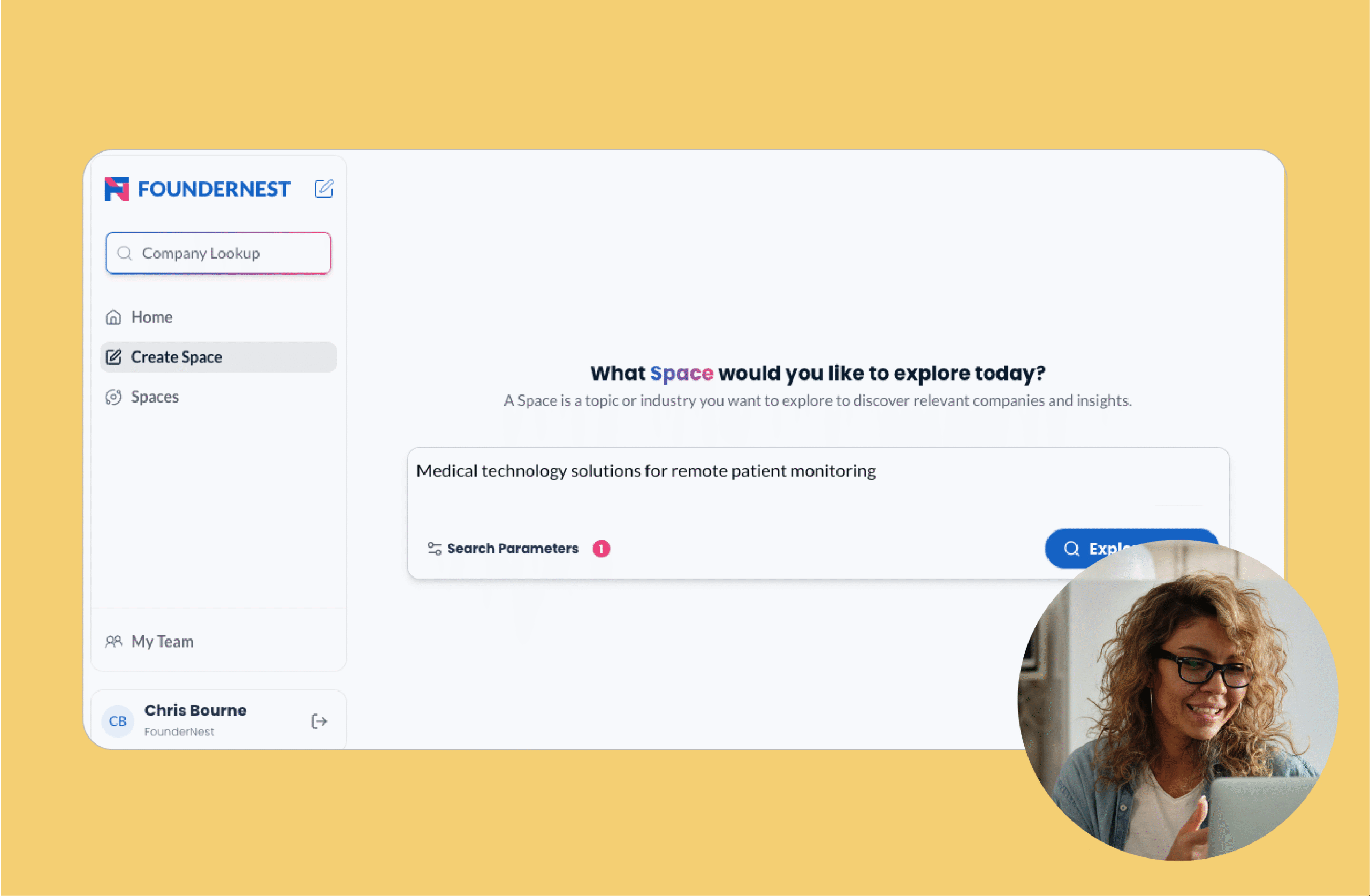

The FounderNest approach

Market intelligence platforms like FounderNest make this possible at scale by mapping markets for you in seconds. Surface emerging players, track target companies, and get updates on the latest news and trends in that market in real-time so you always have a complete, reliable view of the landscape. Request a demo to see it in action.

Pillar 2: Dedicated bandwidth

Why scouting can’t be a side project

Many teams treat scouting as a job for “when there’s extra time.” It’s understandable but it’s also one of the biggest reasons scouting efforts fail.

Without dedicated bandwidth, teams struggle with

- Inconsistent discovery

- Shallow expertise

- Missed opportunities because no one is actively looking

What “dedicated bandwidth” looks like

- Full-time or near-full-time scouting roles

- Protected time for research, founder conversations, and trend tracking

- Budget for tools, travel, and ecosystem engagement

- Executive sponsorship that treats scouting as strategic, not optional

Common pitfall: The “innovation theater” trap

Some teams look busy, hosting events, attending conferences, creating slide decks, but never build meaningful capacity. Activity ≠ capability. To escape it, we recommend the PACE innovation scouting framework.

Pillar 3: Partner Networks

Why your network is your deal flow

The highest-quality startup opportunities rarely come from cold outreach. They come from trusted referrals.

VCs, accelerators, and other ecosystem players are gatekeepers to the startups you want to meet and the earliest signals you want to track.

Building strategic partner relationships

Your partner network should include

- Venture capital firms and angel investors

- Startup accelerators and incubators

- Industry associations and innovation hubs

- Academic institutions and research labs

- Peer corporate innovation teams

How to activate your network

- Maintain relationships year-round, not just when you need something

- Share insights generously

- Stay top-of-mind with periodic updates

- Create value before you ask for it

Pillar 4: Internal clarity

The hidden killer: Internal misalignment

Nothing stalls scouting like internal confusion. Scouts discover great startups only to see them killed during internal review because the criteria changed mid-process.

What “internal clarity” means

- A clear investment thesis: What themes matter most?

- Defined evaluation criteria: Stage, geography, traction, strategic fit, etc.

- Aligned stakeholders: Who must sign off?

- Documented decision processes: What are the gates? How long do they take?

Creating your scouting playbook

Document everything, from criteria and workflows, to ownership and timelines. Your team shouldn’t have to reinvent the process every time.

Pillar 5: Startup ecosystem fluency

Speaking the language of startups

Many corporate teams struggle to connect with founders because they don’t speak the same language. The culture gap is real.

What “ecosystem fluency” looks like

- Understanding startup funding stages and how they impact urgency

- Knowing what founders actually need from corporate partners

- Following ecosystem trends, not just reading the headlines

- Engaging authentically, not transactionally

- Moving at startup speed, not corporate pace

Building your fluency

- Attend startup events

- Follow leading founders, investors, and operators

- Work closely with startups regularly not just in pitch meetings

The outcome: Decision-readiness

Why all five pillars lead here

The goal of great scouting isn’t just discovery, it’s decision-readiness.

Decision-ready teams can act quickly when the right opportunity appears.

What decision-ready organizations do differently

- Pre-approved budgets and processes

- Fast evaluation timelines (days or weeks, not months)

- Empowered decision-makers close to the scouting function

- Clear pathways from discovery to evaluation to partnership/investment

Common Mistakes That Undermine Great Scouting

Mistake 1: Starting with outreach instead of research

Without market mapping, you only see a fraction of the landscape.

Mistake 2: Treating scouting as “innovation theater”

Activity without capability leads to lots of meetings and few results.

Mistake 3: Building relationships only when you need something

Partnerships grow from consistency, not urgency.

Mistake 4: Unclear internal criteria that change mid-process

This erodes credibility and slows everything down.

Mistake 5: Approaching startups with corporate arrogance

Founders value authenticity, clarity, and speed, not bureaucracy.

How to build your innovation scouting system

Start with pillar 1: Map your space

Begin by building a comprehensive, dynamic understanding of your target markets.

Then build sequential capabilities

- Add dedicated bandwidth

- Establish partner networks

- Align internal stakeholders

- Strengthen startup fluency

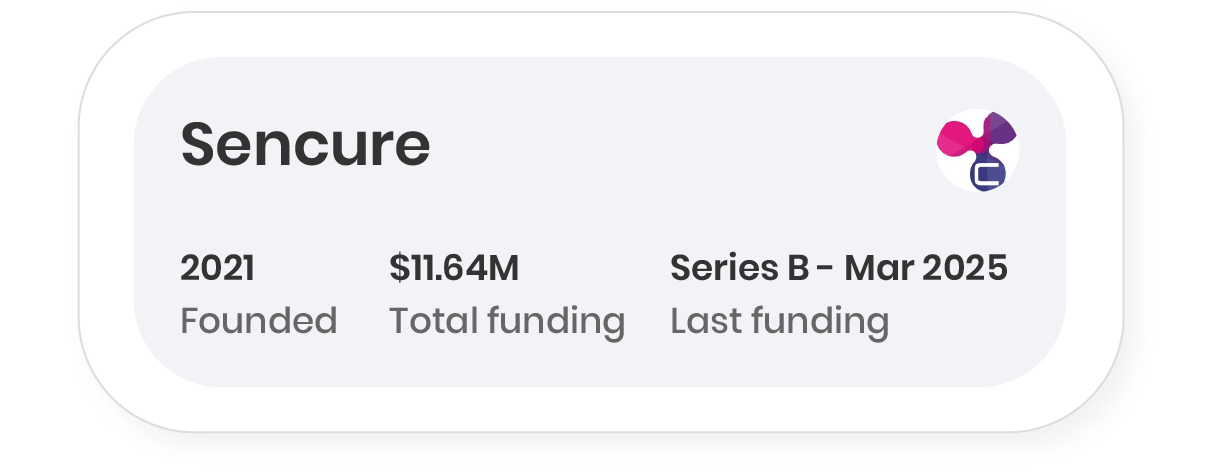

Leverage technology to scale

AI market intelligence platforms like FounderNest make innovation scouting ten times more effective by mapping markets automatically, surfacing emerging companies, and providing trusted and accurate data so scouts can focus on high-value decisions.

From ad-hoc activity to strategic advantage

Innovation scouting isn’t just about finding startups, it’s about building a system that consistently identifies the right opportunities at the right time.

Teams that build the five pillars outperform those that rely on ad-hoc searches and one-off initiatives. The result? Faster decisions, better partnerships, and a lasting competitive edge.

Time to improve your innovation scouting strategy? Request a demo of FounderNest today.