Teams responsible for innovation, corporate development, strategy, or M&A feel the increasing pressure to make faster decisions with deeper evidence. They want due diligence company insights that are trustworthy, comprehensive, and instantly accessible.

They need visibility into sanctions and litigation risks, clarity on geographic operations, and to know whether a company truly aligns with internal strategic priorities.

The problem is simple. Modern markets move faster than traditional research workflows. The level of noise is rising. And the risk of making decisions with incomplete data is higher than ever.

It’s why better due diligence intelligence matters. So let’s look at how leading organisations are transforming the way they gather and validate company insights.

The rising need for deeper due diligence company insights

For innovation and M&A teams, the difference between a good investment and a costly mistake often comes down to access to reliable information. Yet most organisations still rely on fragmented research processes.

Traditional research workflows fall short

Most workflows were built for a different era. Teams stitch together findings from Google searches, analyst reports, press releases, LinkedIn, and legal databases. This creates three recurring problems:

- Important risk signals get missed

- Teams lose hours verifying scattered information

- Decisions get delayed because confidence is low

More than 60% of corporate development teams say their biggest bottleneck is information fragmentation, especially when evaluating early stage companies. Innovation teams often underestimate regulatory and litigation risks because they lack unified due diligence tools.

When the cost of an oversight can reach millions, lack of visibility is not a small issue. It is a strategic liability.

Public sanctions and litigation checks are now expected

Sanctions, regulatory violations, and litigation history can dramatically reshape the risk profile of a potential partner or acquisition target. This is especially true in sectors like energy, infrastructure, pharma, transportation, defence, fintech, and telecommunications.

The growing complexity of sanctions

Global sanctions frameworks have expanded significantly since 2020 and sanctions lists globally have grown more than 35 percent in four years.

For organisations that source startups internationally, this creates a real challenge. A company may be headquartered in one country, have subsidiaries in others, and operate through distributors or shell entities elsewhere.

Ensuring compliance requires more than checking one database. It requires a system that continuously monitors multiple global lists and flags emerging risks in real time.

Why litigation history matters

Litigation does not mean a company is unfit to partner with. But knowing the context gives teams the clarity they need to proceed with confidence.

Several studies show the correlation between ongoing litigation and decreased valuation in M&A transactions. Even small risks can materially impact deal timelines, integration exposure, or reputation.

Our customers often summarise it simply: “We need to know what we are walking into.”

Geographic operations need more clarity than ever

Knowing where a company operates used to be straightforward. Today, global supply chains are dynamic, distributed, and constantly shifting.

Why customers are prioritising geographic intelligence

Teams want clarity on:

- Where a company is legally registered

- Which countries it operates in

- Where it sources, manufactures, or partners

This matters for several reasons.

Market access

Many industries face region-specific regulatory constraints. A promising startup may face long approval timelines or import restrictions in certain jurisdictions.

Compliance and ethical sourcing

Supply chain transparency has become a board level priority. 69% of companies invest in supplier transparency tools to avoid reputational risks and maintain ESG commitments.

Strategic alignment

If a company has strong operations in markets where your business is trying to expand, that may strengthen the case for partnership or acquisition.

Geographic ambiguity is no longer acceptable. Teams need precise, regularly updated data to support confident decisions.

Alignment with strategic priorities has become non negotiable

Even when a company is operationally sound and legally low risk, the question remains. Does it fit your strategy?

Our conversations with innovation teams consistently reveal a shift in how alignment is measured.

Strategic alignment is not just about industry fit

Teams now evaluate alignment based on:

- Technology maturity

- Regulatory posture

- Integration feasibility

- Cultural compatibility

- Long term relevance to strategic roadmaps

For example, a corporate venturing team might look for startups aligned with decarbonisation, circular production, or AI automation. Meanwhile an M&A team might prioritise geographic expansion or vertical consolidation.

In both cases, alignment goes far beyond surface level keywords. It requires high resolution visibility into a company’s capabilities, partnerships, IP, customer segments, and evidence of commercial traction.

The most successful teams use due diligence company insights not as a checkbox exercise but as a strategic accelerator.

Why better due diligence company insights reduce operational risk

A 2023 Deloitte study found that poor due diligence is one of the top reasons corporate acquisitions underperform. Even minor oversights can snowball into significant risks.

The cost of incomplete due diligence

When insights are incomplete, teams face:

- Delayed deal cycles

- Escalating legal costs

- Surprises during integration

- Reputational damage

- Unnecessary internal debate

Meanwhile, organisations with strong due diligence processes see smoother negotiations, higher confidence from internal stakeholders, and faster time to greenlight.

The psychological side of due diligence

Teams that lack reliable intelligence often overestimate risk out of caution. This slows down high potential opportunities. Conversely, teams that rely on superficial data risk entering deals too quickly.

Reliable insights bring balance. They replace guesswork with clarity.

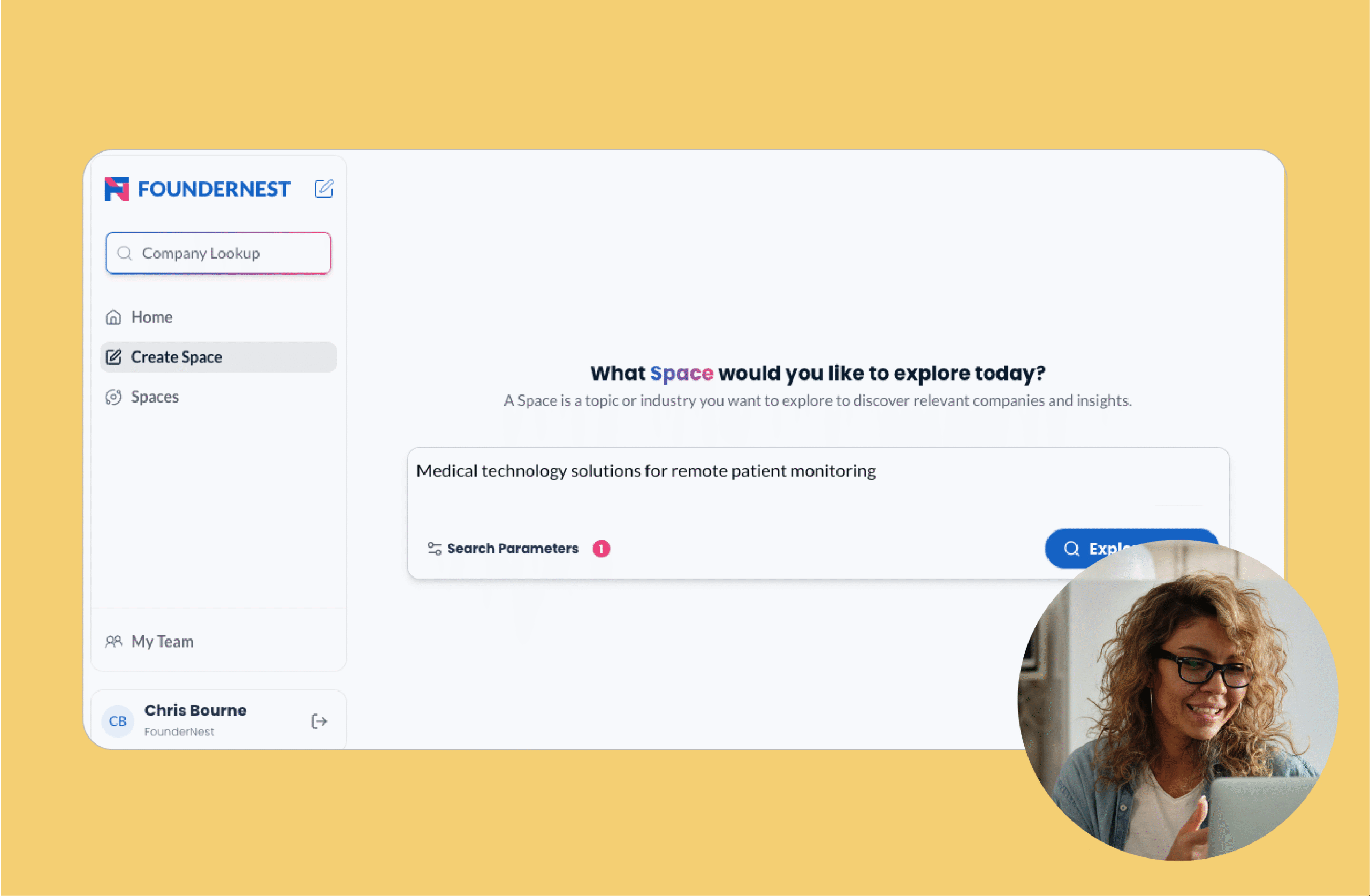

Innovation and M&A teams want information they can trust instantly

During our calls with customers, one request keeps coming up:

“We need a single place where we can understand a company and whether it aligns with our priorities.”

This is where modern market intelligence platforms add real value.

Innovation teams do not want to search multiple databases, cross check outdated documents, or spend 15 hours Googling a single company only to get caught up by legal checks.

They want instant, accurate, and contextualised insight.

How organisations are adapting to a new due diligence reality

Leading innovation and M&A teams are rebuilding their workflows to match market speed. The most progressive teams tend to follow a similar pattern.

They centralise company insight data

Instead of keeping research findings in multiple spreadsheets, tools, and inboxes, teams consolidate data into one accessible platform. This drastically reduces duplication and improves the signal to noise ratio.

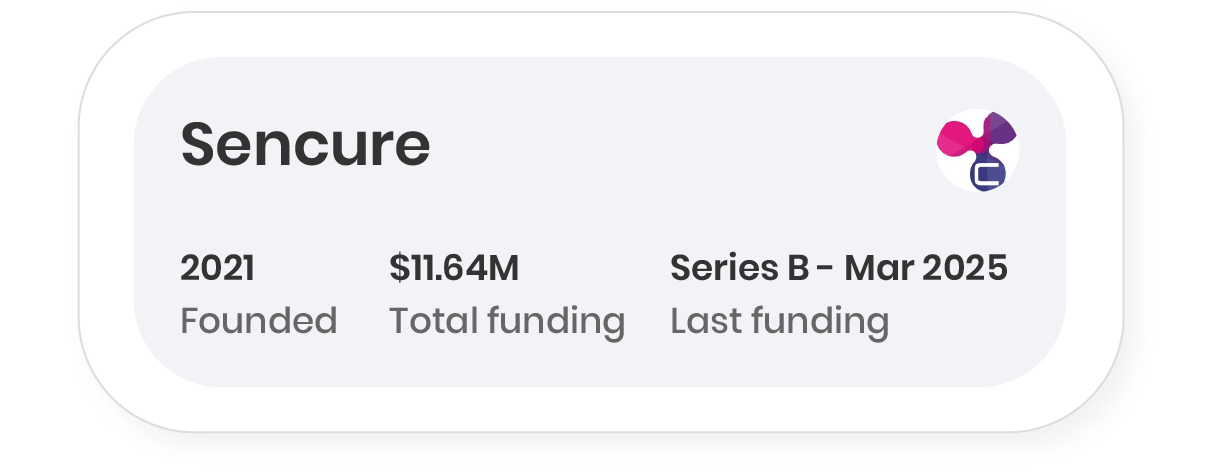

They introduce automated early risk detection

Instead of finding out about sanctions, lawsuits, or regulatory issues late in the process, automated monitoring surfaces them instantly. This saves time and protects teams from avoidable surprises.

They upgrade strategic alignment frameworks

Leading organisations build internal models that quantify alignment. For example, a company may be scored across areas like fit with corporate strategy, market relevance, technology readiness, and partnership potential. This turns qualitative judgment into structured decision making.

They emphasise transparency across teams

Legal, strategy, innovation, corporate venturing, procurement, and business units often evaluate the same companies. A centralised due diligence platform helps everyone work from the same baseline.

Why next generation due diligence is becoming a competitive advantage

Companies that master fast, reliable due diligence will win the race for innovation opportunities. Those that do not risk moving too slowly or acting on incomplete intelligence.

Innovation teams are increasingly judged on their ability to detect promising technologies, reduce risk, and act with confidence. M&A teams are judged on the quality, timing, and outcomes of their deals.

Better due diligence company insights are no longer a back office function. They are a core differentiator that shapes growth, competitiveness, and strategic positioning.

Explore our public market spaces for free live updates in various industries or take your company intelligence to new heights with FounderNest and request a demo today.

Research sources

- Gartner Corporate Development Benchmarks for 2024

- Center for Economic and Policy Research Global Sanctions Growth Report, 2024

- Harvard Law School Forum on Corporate Governance Litigation Risk and M&A Decision Making

- EY Global Risk Survey 2023

- Deloitte M&A Trends and Pitfalls Report 2023

Frequently asked questions

- What are due diligence company insights?

These are structured pieces of intelligence about a company that help evaluate risk, alignment, and commercial potential. - Why are sanctions and litigation checks important?

They reveal potential regulatory or legal risks that may affect partnerships, procurement, or acquisitions. - How do geographic operations influence due diligence?

They determine regulatory exposure, market access, supply chain stability, and strategic expansion opportunities. - What does strategic alignment mean in due diligence?

It refers to how well a company fits your organisation’s long term priorities, capabilities, and roadmap. - What tools help automate due diligence?

Market intelligence platforms that consolidate company data, risk signals, and strategic insights into one system.