Every high-performing innovation organization eventually discovers the same truth: brilliant ideas don’t matter if the portfolio behind them is unbalanced. Too many moonshots and the organization loses patience. Too many incremental improvements and teams stagnate. Too many mid-range projects and nothing truly transformative ever breaks through.

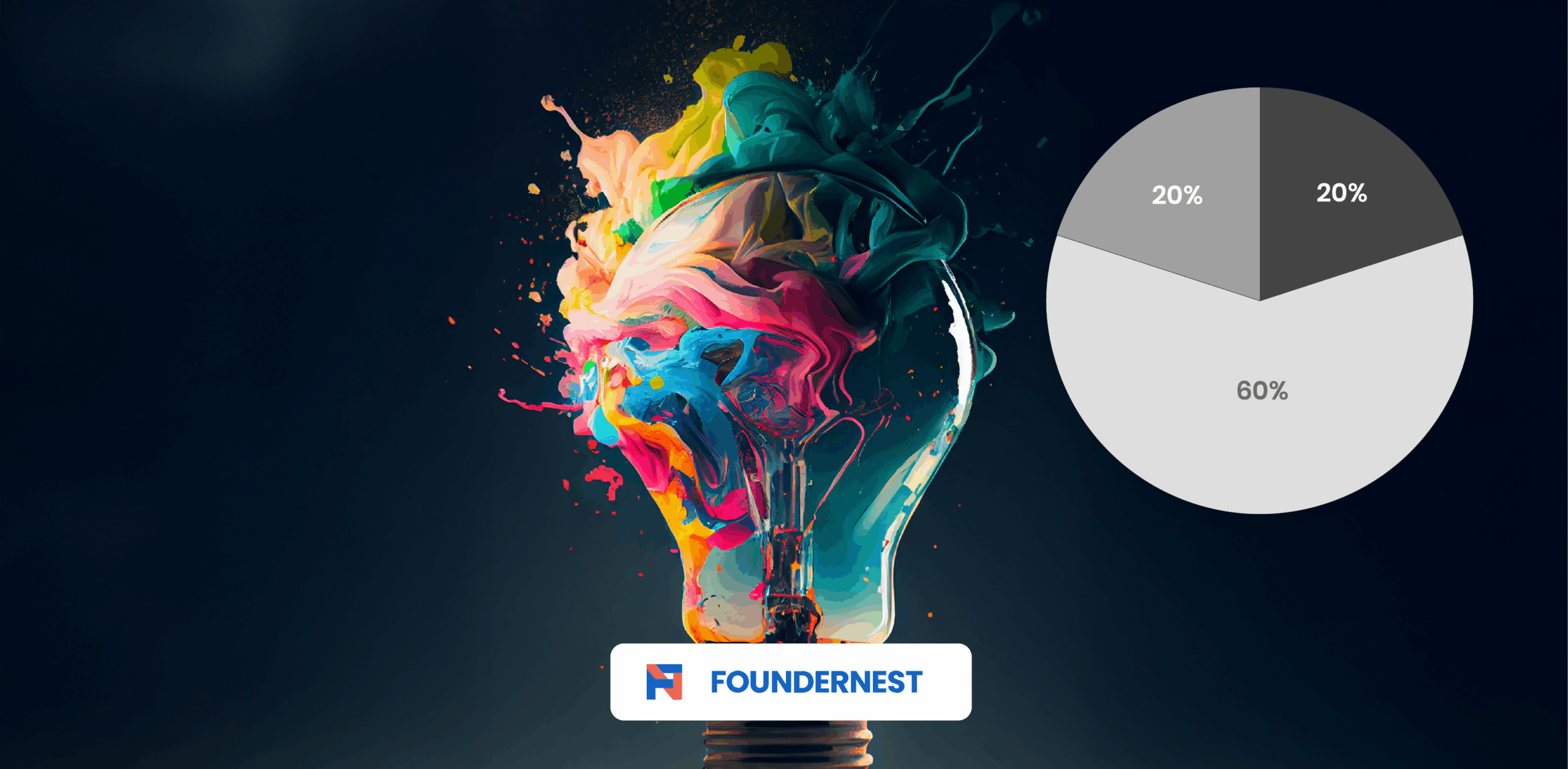

This is why the world’s best innovation and strategy teams operate by a clear portfolio principle: the 20/60/20 rule.

It’s a deceptively simple model.

20% future bets, 60% scale-ready projects, 20% core improvements, but it underpins some of the fastest and most predictable innovation engines in the world.

Let’s break down what each layer really means, why it matters, and how the data supports this balance.

20% – Future bets: Your long-term growth engine

This top slice is where companies explore what might become the next S-curve.

These are the experiments that feel uncomfortable, unconventional, or too early. AI-native business models. Materials breakthroughs that could reshape manufacturing. Bold sustainability plays. Entirely new categories of customer value.

Future bets rarely bring immediate revenue, but they do something more important:

They protect the organization from irrelevance.

Without these explorations, companies risk becoming excellent at yesterday’s business. And once disruption hits, even well-run incumbents struggle to catch up.

The goal here is not volume. It’s learning: what will matter three to five years from now, and how quickly can the organization understand it?

Elite teams keep future bets lean, measurable, and time-boxed, but they never starve them.

60% – Scale-ready projects: The heart of innovation ROI

This is where the engine lives.

Sixty percent of the portfolio focuses on projects with validated demand, credible business cases, and strong cross-functional backing. They’re proven enough to justify investment, but still early enough to yield meaningful upside.

These are the initiatives with real momentum:

- Emerging tech that’s graduated from the pilot phase

- Solutions that business units are ready to absorb

- New customer propositions with evidence of traction

- Platforms and tools the organization can roll out broadly

Top teams treat scale not as ‘the thing that might happen someday,’ but as a deliberate, structured process. And it pays off.

Yet here’s the catch: scaling doesn’t succeed without the third pillar…

And this is where most innovation engines fail.

20% – Core improvements: The underrated foundation of all innovation

This final 20% is the least glamorous, but perhaps the most essential.

Core improvements include:

- Modernizing legacy systems

- Fixing customer experience gaps

- Reducing technical debt

- Strengthening operational stability

- Improving processes for speed and reliability

Teams often skip this layer because it feels like ‘operations, not innovation.’ But the numbers tell a very different story:

- 70% of innovation pilots fail to scale due to weak underlying systems.

- Modernizing the core yields 20–40% efficiency gains within 12–24 months.

- Addressing technical debt early reduces future costs by up to 30%.

- Improving foundational systems increases innovation throughput by 1.5–2×.

In other words:

If you ignore the core, the rest of your portfolio becomes theatre.

The best teams invest here not because it’s exciting, but because it multiplies the impact of everything else. Modernized systems make scaling faster. Stable processes make experiments safer. Clean data makes discovery sharper. A strong core is an innovation accelerator – one that compounds year after year.

Why the 20/60/20 balance works

The magic of this model is that it protects against the three biggest portfolio risks:

- Too many moonshots → no tangible impact.

- Too many mid-range projects → no breakthrough growth.

- Too few core upgrades → no ability to scale anything.

The 20/60/20 rule ensures that:

- You explore what’s coming next

- You invest heavily in what can scale today

- You strengthen the systems that make both possible

It’s balance without stagnation. Discipline without rigidity. Creativity without chaos.

The bottom line

Top innovation teams don’t rely on heroics or luck. Instead they rely on portfolio discipline, a structured rhythm that mixes long-term bets with near-term wins and operational foundations that remove friction from scale.

In a world where technologies shift fast and expectations shift even faster, the organizations that master this balance won’t just innovate more.

They’ll innovate more predictably, more sustainably, and more profitably.

If your portfolio feels overextended, underpowered, or stuck in perpetual pilot mode, the 20/60/20 rule is the simplest way to restore clarity and momentum.