From the uprise of AI, blockchain, and VR, to self-driving cars and the black shiny screens of glass on the desk beside us. We encounter innovation every day. So much so that everyone knows what innovation is, right?

Unfortunately, what is widely considered by boardroom execs as “innovation” is fundamentally flawed.

Over the last few decades the big talking points when it comes to innovation have all been various technology or tech advancements. It’s curated the perfect storm that shifted the perspective of innovation entirely. And today, we find that innovation and technology have become synonymous.

Today, C-suite equates innovation budgets with technology budgets and this innovation misconception is costing businesses billions.

Yet technology doesn’t mean innovation anymore than innovation doesn’t always mean technology. In actual fact, many of the largest business breakthroughs weren’t new technology at all.

When did innovation become a synonym for technology?

Two words. “Digital Transformation” – two words could send a shiver down the spine of a seasoned innovation vet.

During the 2010s the Digital Transformation era started blurring the lines between innovation and tech due to the volume of new technology launching and the fast adoption from businesses and consumers alike.

New tech was convenient, often quick and cheap to implement compared with analog process changes, and that made it a consultant’s dream.

The consultant effect began ramping up, making “digital innovation” the buzzword in every boardroom across the globe.

The innovation failures were quickly forgotten and focus quickly switched to the huge success stories instead. But increasing tech spend didn’t mean increased innovation.

In fact only around 35% of an organization’s digital transformation initiatives actually achieve their objectives and over $2.3 trillion is wasted globally on failed programs.

Lost in translation

Innovation is about creating and capturing value, and technology is just one part of that. In fact, there are 5 types of innovation that don’t require technology that enterprises actually need:

- Pricing innovation

- Partnership structure innovation

- Business model innovation

- Customer segmentation innovation

- Organizational and Governance innovation

Without a well-executed innovation strategy, dumping cash into technology risks being an expensive status quo. And too often, that’s exactly what happens.

Consider this: only around 35% of companies actually achieve the objectives they set for digital transformation. Even though trillions are poured into digital initiatives globally, somewhere near 70% of those projects still fail to deliver the expected outcomes.

On top of that, a shocking 91% of businesses say they’ve made a software investment that failed to live up to expectations.

These aren’t just tech flops, they’re innovation failures.

Business model innovation: The blind spot that’s killing giants

It doesn’t need to be about digitizing your existing business model, it’s about questioning your core revenue assumptions. It means reimagining how value is created, delivered, and captured.

Compared with some flashy new tech, business model innovation is scary and far less “sexy”. To really innovate a business model, organizations often have to cannibalize existing revenue streams or admit that “this is how we’ve always worked” no longer works – and that bites.

Worse, many executives confuse digitizing the business model with innovating the business model. They’ll launch an app, build a new site, or move services to the cloud and call it innovation, but really nothing has fundamentally changed.

Real-world casualties and victors

Casualties:

- Blockbuster tried adding streaming but kept its late-fees and pay-per-rental mentality.

- Taxi firms built apps but didn’t rethink how drivers are paid, how demand is matched, or how to monetize.

- Legacy retailers layered e-commerce on top of massive, legacy cost structures without rethinking inventory, logistics, or fulfillment.

These are all examples where technology was added but the core business model stayed the same and led to financial decline.

Victors:

- Netflix transformed from DVD rental to a subscription model.

- Amazon developed its marketplace to become a platform, not just a retailer.

- Spotify challenged the notion of ownership, offering access over purchase.

- Dollar Shave Club disrupted by combining D2C (direct-to-consumer) with a subscription model

These companies didn’t just digitize, they reinvented how value flows and saw huge success.

Why Execs Resist Business Model Innovation

If business model innovation is so powerful, why do so few leadership teams actually do it? They often see the disruption coming, but the barriers are psychological, political, and structural, rarely technological.

Cannibalization fears

Most established businesses have a model that reliably throws off revenue. Suggesting a new one can feel like suggesting they dismantle the very machine that pays everyone’s salaries.

To many execs, the logic is simple: Why would we create something that competes with our own cash cow?

And that mindset is exactly why disruptors start outperforming.

Quarterly earnings pressure

Innovation lives on long time horizons. Public markets don’t.

Boards want results in 90-day increments, even when the company is operating on a 5–10 year risk curve. Business model shifts usually look messy at first: revenue dips, margins compress, and old KPIs stop making sense.

Internally, even an obviously better long-term model can be killed by a single slide showing the short-term impact on EBITDA.

Mental models locked in

Executives often climbed the ladder by mastering the existing business model. Their expertise is built on what worked, not what could work.

Their experience became a trap of one dimensional thinking and wanted to stick to “how we’ve always made money.”

By the time leaders update their assumptions, more adaptable competitors have already rewritten the rules, and the business becomes a trend follower rather than a trend setter.

The innovator’s dilemma is alive and well

The unfortunate truth is that companies optimize themselves into irrelevance. They become brilliant at serving current customers with current offerings until emerging players reshape demand entirely.

Every industry giant that fell in the last two decades followed this pattern. They listened to their best customers, not their next customers. They optimized for today’s performance, not tomorrow’s possibilities.

And while they were busy protecting what worked, a competitor was busy implementing what would replace it.

Organizational design: The innovation bottleneck no one’s fixing

For years, executives have blamed slow innovation on technology, budgets, talent shortages, or regulatory friction. But the real bottleneck is far more fundamental and far less discussed: the organization itself.

You might have vision. You might have budget. But if your organizational design is still wired for 1998, you’re not innovating, you’re just performing innovation theater.

The organizational structure problem

Most enterprise organizations were designed for an era of predictability; stable markets, slower change cycles, and hierarchical chains of command optimized for control.

But none of that maps to today’s environment, where speed, iteration, and distributed decision-making are the real competitive advantages.

Despite this, companies still cling to org charts built like pyramids – rigid at the top, siloed in the middle, and bottlenecked everywhere else.

However, the cool kids on the block like Google and Slack began operating with unconventional organization structures while performing extremely well, and so began the trend. Whether businesses successfully implemented these new organizational structures is a different story.

Innovation theater: labs, incubators, and accelerators disconnected from the core

Organizations responded by creating “innovation labs” – sleek glass rooms filled with sticky notes, 3D printers, and job titles like “Chief Futurist.”

But these labs often sit on the fringes of the business with no power to change the operating model, no access to real customers, and no path to scale anything they build.

It’s a corporate museum exhibit that says; “Look, we’re innovating.”

Meanwhile the core business keeps running the same playbook.

Siloed functions that block cross-pollination

Marketing doesn’t talk to engineering. Engineering doesn’t talk to operations. Operations doesn’t talk to anyone.

Each department optimizes for its own KPIs, budget, and political turf. Why? Because that’s where they are being measured.

But breakthrough innovation almost always comes from the intersection of functions, perspectives, and expertise.

Keeping teams in silos guarantees those intersections never happen.

Decision-making hierarchies that slow innovation to a crawl

Even when teams have good ideas, they still have to navigate a maze of approvals. In fact, we asked innovation leaders what was the number one thing killing innovation. Their response? Long, drawn-out approval processes.

It means that by the time anyone says yes, the window has closed, competitors have moved, or the idea has lost all momentum.

Innovation dies not because it was bad but because the organization was too slow to let it live.

What actually needs to change

As a child I’d rearrange the undesired food on my plate to make it look like I’d eaten more than I actually had. And in a sense, businesses are doing the same about innovation.

They make small, non-committal tweaks that “move things around” but never actually change the landscape.

If businesses are serious about innovation, they need to start digging in. Here’s how:

Autonomy and accountability structures

Teams need the authority to make decisions quickly and the responsibility to own outcomes. Real innovation requires both autonomy and accountability, simultaneously.

Cross-functional team design

The most effective innovation teams aren’t departments, they’re ensembles. Product, engineering, design, finance, compliance, and commercial roles working as one unit with a shared mission. It’s not just collaboration. It’s integration.

Innovation metrics that go beyond revenue growth

If the only KPI is revenue, every idea becomes a short-term financial debate instead of a strategic conversation.

Innovation needs metrics like:

- speed of learning

- customer behavior change

- time-to-experiment

- portfolio diversity

- optionality created

Revenue is a lagging indicator. Learning is the leading one.

Psychological safety and failure tolerance

Innovation requires trying things that might not work. But in most enterprises, failure is punishable, mistakes are political, and risk-taking is career-limiting. It’s no surprise that teams default to safe ideas.

The role of middle management

Middle managers are often the unsung heroes, or the quiet killers, of innovation. They’re squeezed between strategy and execution, rewarded for stability, and punished for deviation. If middle management incentives aren’t redesigned, innovation efforts die in the middle long before they reach the top.

Examples of organizational design innovation

Some companies realize that structure, not technology, was the real constraint, and have redesigned organizational structure with that in mind.

Spotify’s squad model

Small, autonomous squads with end-to-end ownership over parts of the product. Not perfect, but highly influential in redefining how modern teams work.

Haier’s microenterprise approach

Thousands of micro-enterprises operating like independent startups inside the company, each with its own P&L. Decentralization pushed to its extreme and it worked.

Amazon’s two-pizza teams

If a team can’t be fed with two pizzas, it’s too big. Lean, empowered, and relentlessly customer-obsessed.

Companies reorganizing around customer journeys, not functions

Instead of marketing here, sales there, operations somewhere else, teams are aligned around the end-to-end experience of a customer problem. No handoffs. No silos. Just accountability for outcomes.

The GenAI gold rush: History repeating itself

If the last decade was defined by the Digital Transformation wave, today is defined by something even more frenzied: the GenAI gold rush.

It’s the same pattern, just with sharper edges and bigger budgets.

The current hysteria

Executives are pouring billions into GenAI initiatives and board meetings have become countdown clocks desperate to get AI into the roadmap and get ahead of competitors.

GenAI hasn’t just become a technology priority. It’s become a symbol of leadership decisiveness. Or worse – a badge that says “we didn’t get left behind.”

This is FOMO-driven spending at scale.

Companies are announcing “AI strategies” with little thought into whether the business even has the foundations to use any of it meaningfully. But that hardly matters in the rush, what matters is being able to say, “We’re doing AI.”

It’s innovation theater 2.0. Only now the stage props are stage prompts.

The misalignment problem

Underneath the hype sits the real issue: misalignment. Not between teams but between technology and actual business value.

Technology first, problem second

Many leaders are buying GenAI solutions and then searching for a justification. It’s solutionism disguised as innovation.

Lack of clear use cases tied to strategic objectives

Implementations often amount to scattered pilots, vendor demos, and isolated POCs. The question “How does this support our strategy?” rarely gets a clear answer. The question “How does this make us money?” rarely gets asked at all.

Ignoring organizational readiness

GenAI isn’t plug-and-play. If the organization is built for linear processes, rigid approvals, and siloed functions then AI simply hits the same walls as everything else.

Data infrastructure gaps

AI without strong data foundations is like a race car without fuel. Most enterprises discover this only after they’ve already spent millions.

Change management as an afterthought

Even when the tech works, people still need to adopt it. Most teams are not trained, supported, incentivized, or reorganized for AI-augmented workflows. So adoption stalls and executives blame “the AI” instead of the operating model.

What aligned GenAI innovation actually looks like

When GenAI and innovation are aligned, the conversation sounds completely different.

It doesn’t start with “What AI tools should we buy?”

It starts with “How could AI change the way we create and capture value?”

This is business model innovation first, technology second. AI becomes a lens for revisiting pricing, distribution, cost structure, and customer engagement, not just a workflow optimizer.

Process redesign opportunities

It’s time to think about things differently. AI in the context of automation alone isn’t enough. Instead of thinking about what to automate, think about which workflows should be reimagined entirely.

Organization design implications

AI-ready organizations need different roles, different skills, and different structures.

- Teams shift from task execution to problem definition

- Managers evolve from controllers to coaches

- Governance becomes faster, more distributed

Without this, GenAI becomes another expensive tool sitting unused.

Examples of enterprises doing GenAI innovation

- Using AI to unlock new business models such as dynamic pricing engines, fully personalized service models, and AI-powered marketplaces.

- Restructuring teams around AI-augmented workflows and implementing hybrid human + AI operations, expertise-on-demand models, and AI-first product squads.

- Reimagining customer value propositions such as hyper-personalized journeys, predictive service experiences, and AI advisors replacing static content.

Time to Unlearn and Relearn

Innovation isn’t a tool. It isn’t a dashboard. It isn’t a line item in a tech budget.

It’s strategic, multidimensional, and often non-technical. It lives in business models, pricing, partnerships, organizational design, and yes, technology but only when applied thoughtfully.

Innovation doesn’t mean new technology. And organizations that don’t accept this find themselves with wasted resources, disengaged talent, and missed opportunities.

Every misaligned AI rollout or siloed lab or “digital transformation” that fails to transform is a reminder that spending money isn’t the same as creating value.

The opportunity, however, is enormous.

The companies that take a step back, ask the hard questions about how they create and capture value, and redesign both business models and organizational structure to make innovation happen are the ones that will dominate the next decade.

They won’t necessarily have the most advanced tech. They’ll have clarity about what innovation actually means, and the accountability to act on it.

If you’re reading this and thinking about your own organization, now is the time to start asking: “Are we innovating, or are we just keeping up appearances?”

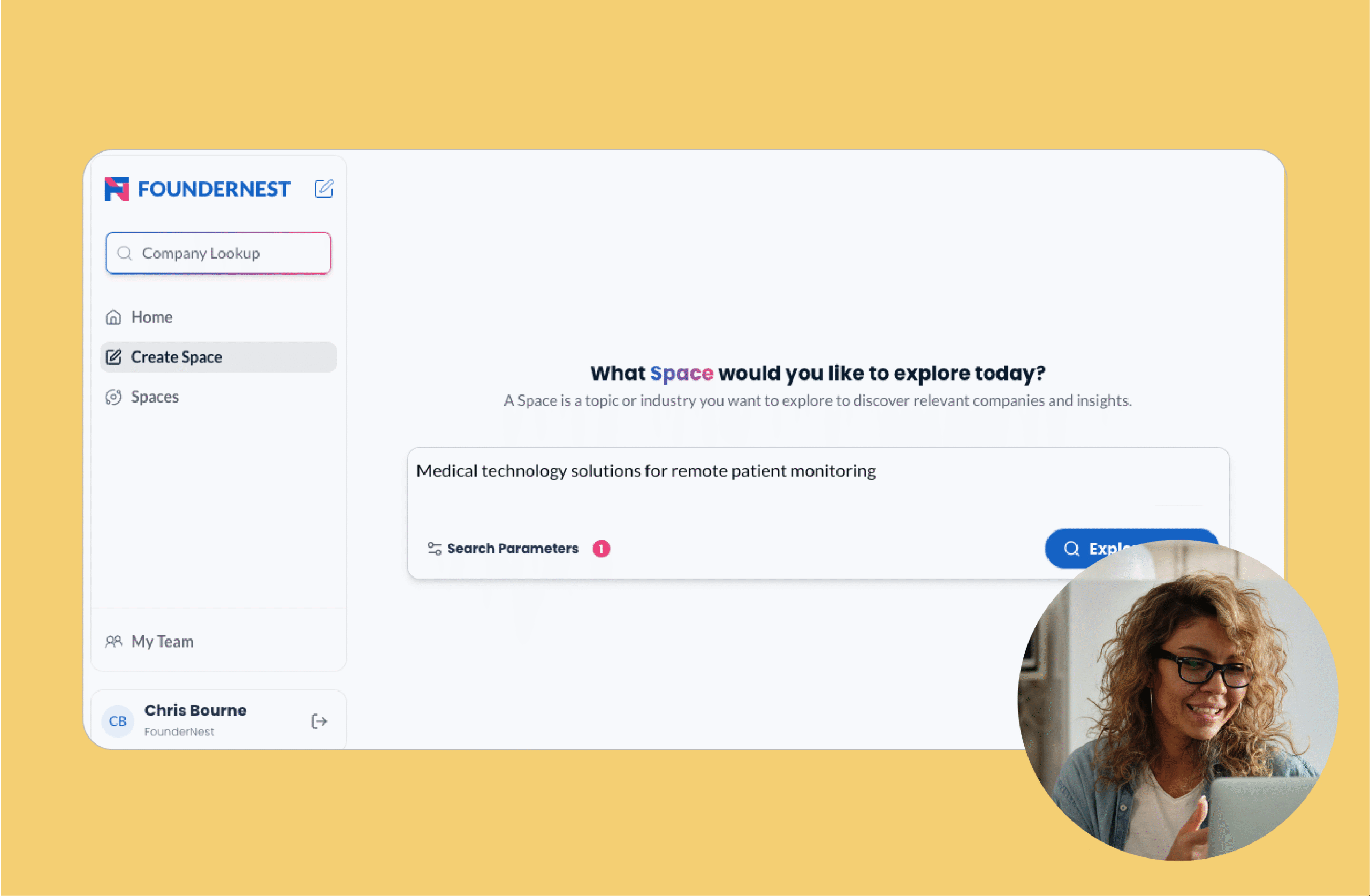

Request a demo of FounderNest and we’ll show you how companies like Novo Nordisk, Roche and Kyocera use FounderNest to drive your innovation forward.